Overview of University Revenues

In this section:

Overview of University Revenues

Sales of Services and Products

Non-Credit Fees

Grants

Donations (Non-Endowed)

Credit Tuition and Fees

Investment Revenue

Scholarship/Awards Selected by External Organizations

Summary - What To Do When a Cheque is Received

Appendix - Is Revenue a Grant, Donation or External Sale?

Overview of University Revenues

For all sources of revenue, the following applies:

1. Only revenue to which the university is legally entitled is accepted and deposited to university bank accounts and administered through the university financial system.

2. All university revenue must be deposited to university bank accounts and accounted for within the university financial system.

3. The university uses the accrual basis of accounting, which involves recording revenue when it is earned (e.g. when the service or product has been provided) regardless of when payment is received.

Accrual accounting also involves deferring revenue when appropriate. At the unit level, external sales revenue may be deferred where payment has been received but the related services and products have not yet been provided. At the institutional level in the university's financial statements, restricted grants and donations and investment revenue from restricted donations are deferred until the terms are met.

4. Only Financial Services (FS) and the Research Services Office (RSO) can process grant revenue. Grant revenue is processed through billings to sponsors to create accounting entries for revenue and accounts receivable. Therefore, units must:

- immediately forward correspondence from sponsors to RSO (research grants) or to FS (operating grants)

- inform the sponsor that all payments are to be sent to Financial Services - Accounts Receivable.

5. Only the Office of Advancement (OA) can process donation revenue. Units must immediately forward donations to OA.

6. All external sales revenue and external cost recoveries are processed through PS Billing (External Billing) or Cashier (Cash Sales).

Cash sales are typically high volume, low value transactions where the customer is physically present when paying for goods and services received (e.g. Point of Sale (POS)). Cash sales also include web-based payments. In such cases the preparation of an external billing invoice would not make sense.

External Billings typically occur when the unit has agreed to receive payment after the goods and/or services have been provided to an external customer. In such cases an external billing invoice must be generated. External Billing transactions are typically higher value transactions involving customers who are neither staff nor students.

|

External Billing must be used to process sales and cost recoveries in all relevant situations to ensure that the university's financial statements and internal reports are accurate by recording revenue when earned and to maximize efficiency for all stakeholders by reducing handling of cash in units and enabling Shared Services to manage customer payments and accounts. |

7. All internal sales revenue and internal cost recoveries are processed through GLJE user interface.

Units sometimes receive cheques for grants and donations and must be able to accurately identify the source of revenue to ensure it is processed by the appropriate unit and accounted for correctly for reporting purposes. It is important for units to understand the distinction between these revenues as external organizations may describe the payments they make to the university differently. The Appendix at the end of this section will assist with identifying whether revenue is a grant, donation or external sale. The unit should contact the faculty's Senior Financial Officer (SFO) if it still cannot determine the revenue source after applying the criteria.

The following summarizes revenue coding and processing requirements.

|

REVENUE SOURCE |

ACCOUNTS AND FUNDS (1, 2, 3) |

TIMING OF PROCESSING |

PROCESSED BY |

|

|

External sales |

Accounts: 402xxx Fund: Operating |

As soon as services and products have been provided |

Units, via:

|

|

|

Internal sales |

Accounts: 401xxx Fund: Operating |

As soon as services and products have been provided |

Units, via GLJE user interface or GLJE request |

|

|

Non-credit fees |

Accounts: 4031x Fund: Operating |

When received or assessed |

Units, via:

|

|

|

Grants |

Accounts: 405xxx-499xxx |

When receivable (e.g. when the award letter is received or start date of award) |

||

|

Operating |

Fund: Operating |

FS, via External Billing |

||

|

Capital |

Fund: Restricted |

FS, via External Billing |

||

|

Research |

Fund: Restricted |

RSO, via External Billing & Cashier |

||

|

Donations (non-endowed) |

Accounts: 405xxx-499xxx Funds: Operating, Restricted |

When received |

OA, via GLJE user interface (DON) |

|

|

Credit tuition and fees |

Accounts: 4030xx Fund: Operating |

When assessed |

Office of the Registrar via Campus Solutions (SAS) (FEE) (4) |

|

|

Investment revenue (including endowment spending allocation) |

Accounts: 404xxx Funds: Operating, Restricted |

Allocated at beginning of year |

FS, via GLJE user interface (END, INT) |

|

|

Notes: (1) Operating funds: includes F210 (Operating), F310 (Ancillary Enterprises), F330 (Research - Operating) and, for the purpose of these guidelines, also includes F551 (e.g. AARP grants), F552 (Student Awards & Bursaries). Some F330 projects may have infrequent, low value grants or donations during the life of the project that are deposited to the project by the unit to the appropriate 405xxx-499xxx account (e.g. a conference for which registration fees are collected may also receive a grant from an external sponsor). (2) Restricted funds: includes F530 (Research), other restricted funds (in rare cases, subject to approval).

(3) An exception to the processing of operating grant revenue by FS is permitted for student employment grants and other small operating grants ($5,000 or less). Refer to Appendix 1 of the External Sales and External Cost Recoveries section of this chapter. (4) Some faculties process fee revenue related to credit courses (e.g. mandatory instructional support fee). For additional information refer to UAPPOL, Student Instructional Support Fees Procedure. |

||||

Sales of Services and Products

External Sales (402xxx account range)

Selling units process external sales.

External sales include:

- revenue from fee-for-services activities and from the sale of products to external parties (e.g. other entities, individuals including university students) in exchange for the fee/price determined by the selling unit.

- certain types of revenue where the external party has an obligation to pay the university but does not receive services or products in exchange (e.g. parking fines, NSF charges)

- Operating grants for student employment programs and other small ($5,000 or less) operating grants. In the interests of efficiency, units can process these as external sales to F210.

The following information is provided in addition to that in the Overview:

- Units should ensure that their prices cover the full cost (both direct and indirect costs) of providing the services and products.

- Units with regular selling activity will use a detailed 402xxx account or request a new account if an appropriate detailed account is not available. Units with ad hoc sales or very low volume selling activity may use account 402001 - External Revenue General.

- External restrictions cannot be imposed on sales revenue.

- The university has established procedures for the recognition of external cost recoveries dependent on the fund type (refer to External Cost Recoveries in the External Sales and External Cost Recoveries section of this chapter).

- Where the sales revenue is received or billed in advance of providing the service or product, it may need to be deferred and recognized as revenue at a later date when the product or service is provided (refer to Deferred Revenue in the External Sales and External Cost Recoveries section of this chapter).

For additional information, refer to the External Sales and External Cost Recoveries section of this chapter.

Internal Sales (401xxx account range)

Selling units process internal sales.

Internal sales include revenue from fee-for-services activities and from the sale of products to other University of Alberta units in exchange for the fee/price determined by the selling unit. Internal sales are recorded when the product or service has been provided.

The following information is provided in addition to that in the Overview:

- The selling unit processes the internal sale transaction, generally through a GLJE user interface that has been set up for the selling unit. Units without a GLJE user interface may have ad hoc sales, which are processed by Financial Services through GLJE requests.

- Units with regular selling activity will use a detailed 401xxx account, or request a new account if an appropriate detailed account is not available. Account 401001 - Internal Revenue General may be used by units with ad hoc sales or very low volume selling activity.

- Internal sales cannot be accrued or deferred, as the university records accruals and deferrals only for external receivables (assets) and payables (liabilities).

For additional information, refer to the Internal Sales and Internal Cost Recoveries section of this chapter.

Non-Credit Fees (4031xx account range)

Units process non-credit fees.

Non‐credit fees include fees for courses, registration and other fees related to non‐credit programs (i.e. those not described in Credit Tuition and Fees below). Various accounts in the 4031xx account range have been set up for non-credit fees.

Where the fee revenue is received or billed in advance of the program, it may need to be deferred and recognized as revenue at a later date when the program is completed (refer to Deferred Revenue in the External Sales section of this chapter).

Grants

FS and RSO process all grant revenue.

A grant is funding provided to the university by a government entity or other external organization for operating or restricted purposes. Restricted grants have restrictions related to specific capital projects, research projects or other purposes.

Donations (Non-Endowed)

OA processes all donation revenue.

A donation is a voluntary and irrevocable transfer of property (including cash, securities, life insurance interest, art or real property) to the university in return for which no valuable benefit flows to the donor.

The following information is provided in addition to that in the Overview:

- OA will issue the appropriate receipt. As a Canadian registered charity, the university may issue charitable receipts (official tax receipts) for donations depending upon eligibility. In some cases, the university may alternatively issue a business receipt.

- Donations can be for operating or restricted purposes. Operating donations include those designated to the university, a faculty, department or other unit with no other restrictions.

Restricted donations can be spent only in accordance with donor terms, and are generally made for restricted research or capital projects, or for student awards and bursaries. Most restricted donations will have a start- and end-date. Some restricted donations are recurring in nature (e.g. annual student award).

Note: The University's Advancement Fund Raising Report is based on counting guidelines outlined by the Council for the Advancement and Support of Education (CASE). Also refer to UAPPOL - Counting Practices for Philanthropic Support Procedure. These allow for the counting of certain grants and sponsorship (which is an external sale) when reporting on fundraising achievement.

Also note: Grants are only processed by central services units (FS and RSO) and external sales of services and products (sponsorship) is processed by units and coded to revenue account 402182. They are not processed through the Office of Advancement.

Refer to the Donations section of this chapter for further information on donations.

Donations (Endowed)

Refer to the endowment section of Chapter 2 (Financial Reporting Overview)

Credit Tuition and Fees

The Office of the Registrar processes all credit tuition and fees.

Note: some faculties process fee revenue related to credit courses (e.g. mandatory instructional support fee). For additional information refer to UAPPOL, Student Instructional Support Fees Procedure.

Credit tuition and fees require approval by the Board of Governors and include (excerpt from Student Instructional Support Fees Procedure):

- instructional fees for supplies, equipment, materials and services directly related to the delivery of instruction in a course or program defined by the Alberta Advanced Education Tuition Fees Policy

- mandatory instructional support fees assessed in anticipation of costs for supplies, equipment, materials, or services which are not directly related to the delivery of instruction in a course or program, but are considered required elements of a course or program (e.g. field trips).

All credit course tuition and fees are operating revenue. Some units will see this revenue in their financial reports.

Investment Revenue

FS processes all investment revenue.

Both restricted funds and operating funds have investment revenue:

- Units will see the endowment spending allocation in their financial reports.

- The majority of all other investment revenue is operating. Some restricted projects may receive interest income due to contractual obligations.

Scholarship/Awards Selected by External Organizations

Office of the Registrar - Student Financial Support processes all funding for awards where the Undergraduate or Graduate student is selected by an external entity.

Organizations may provide funding as an award or scholarship on behalf of a particular student. An attached letter indicating it is an award/scholarship for a specific student typically accompanies this funding. These awards are NOT selected by the University of Alberta, and so this funding is not considered revenue to the university. These are considered "Externally Selected Awards" and are processed as a "payment", which is applied directly to the student's tuition account. Since this is not university revenue, the university does not provide a donation receipt for this type of funding.

Examples of external organizations are as follows:

- Programs and Scholarships - Universities Canada

- Private business that have a scholarship/award program

- Sports Leagues offering scholarships and awards

- Community foundations (e.g. Terry Fox Foundation)

- Union scholarships (e.g. A.U.P.E)

Cheques are processed as they are received and deposited by Office of the Registrar (RO) Finance. Payments are applied to the student tuition account (current term) by RO Student Financial Support. T4A's will be issued by the Office of the Registrar for all Externally Selected Awards. Unless otherwise requested, the RO does not normally notify the student or external entity of receipt of the funding.

What to do (scenarios)

- The funding cheque along with supporting documentation is mailed directly to the Faculty/Department with student name and ID identified:

- The funding cheque along with supporting documentation is mailed directly to the Faculty/Department and the University is requested to select the recipient:

- The funding cheque along with supporting documentation is mailed directly to the Faculty/Department with the student name and ID identified, and the external organization has a requirement for the student to fulfill some type of condition prior to receiving the scholarship/award:

Research Grants and Awards are administered through Research Administrative Services (RAS), and may involve payments to students. RAS:

- reviews and signs agreements,

- ensures that policies are being adhered to

- handles financial matters, e.g. invoicing, reporting, etc.

However, when it comes to hiring and paying students, the paperwork for paying students is not processed with RAS. It is best to consult your HR partner for more guidance as necessary. The project's speedcode will be used as the source of funds in this scenario.

Please note that select graduate awards are administered by the Faculty of Graduate & Postdoctoral Studies (GPS). Please consult the GPS website or contact them for more information.

While the full process is documents on RAS website, it's related to research projects in general and not specific to how students are paid. This page (linked here) in particular goes over managing funding.

Summary - What To Do When a Cheque is Received

The following summarizes the action to be taken by units when they receive cheques:

|

REVENUE SOURCE |

SEND TO |

FORM |

|

Donations |

Office of Advancement |

Donation Deposit/Pledge Transmittal Form |

|

Grants |

Faculty Office |

Cheque Deposit Information Form |

|

Cash Sales |

Cashier (units with deposit books) |

Deposit Form |

|

Financial Services - Accounts Receivable (units without deposit books) |

Cheque Deposit Information Form |

|

|

Faculty Office (units without deposit books) |

Cheque Deposit Information Form |

|

| Scholarship/Awards selected by External Organization | Office of the Registrar - Finance | N/A |

|

Various Other:

|

Financial Services - Accounts Receivable Faculty of Medicine & Dentistry |

Cheque Deposit Information Form |

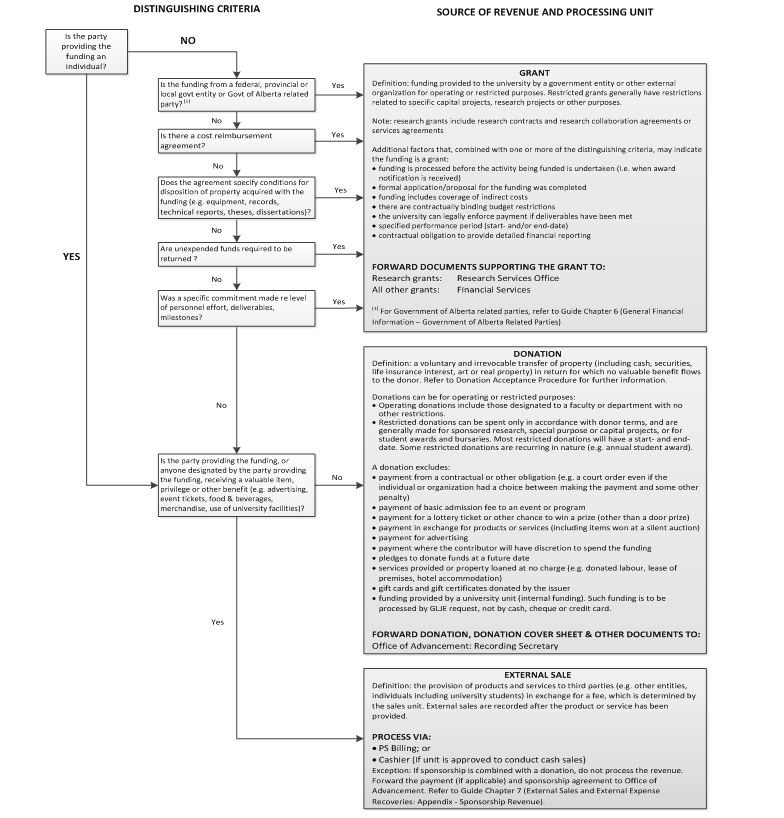

Appendix - Is Revenue a Grant, Donation or External Sale?

The following descriptions illustrate the difference between grants, donations and sales. A decision tree is also provided below with additional information as to the distinguishing criteria.

|

SOURCE |

DESCRIPTION |

|

Grant |

Funding provided to the university by a government entity or other external organization for operating or restricted purposes. Restricted grants generally have restrictions related to specific capital projects, research projects or other purposes. |

|

Donation (non-endowed) |

A voluntary and irrevocable transfer of property (including cash, securities, life insurance interest, art or real property) to the university in return for which no valuable benefit flows to the donor. Donations generally have restrictions imposed by the donor. |

|

External sale |

Includes:

External sales are recorded as soon as the service or product has been provided or, in cases where services or products are not provided (e.g. fines), when receivable. |

|

Internal sale |

Includes revenue from fee-for-services activities and from the sale of products to other University of Alberta units in exchange for the fee/price determined by the selling unit. Internal sales are recorded as soon as the service or product has been provided. |

|

Note: Generally, an external sale is processed (i.e. a receivable or cash deposit) after the product or service has been provided, while a grant is generally processed before the activity being funded is undertaken (i.e. usually when the award notification is received). |

|

Decision Tree: Is Revenue a Grant, Donation or External Sale?

Last Updated: July 2019