Internal Sales, Internal Cost Recoveries and Transfers

Internal Sales

Internal sales include revenue from fee-for-services activities and from the sale of products to other University of Alberta units in exchange for the fee/price determined by the selling unit. This revenue is processed as soon as the service or product has been provided. Internal sales include allocations by units to other units or projects on a recurring basis (i.e. monthly, quarterly) based on usage where the allocation is a fixed amount per unit of usage or consumption (e.g. office expenses such as photocopy charges).

The amount of the fee/price in relation to the actual cost is not the sole determining factor as to whether or not an internal sale has occurred. Even if the fee/price is the actual cost, the transaction is still treated as an internal sale if the unit paying the fee is receiving services (e.g. secondment of a university employee to another university unit) or products.

At times a unit will provide funds to another unit to "sponsor/fund" a program, event or activity. This is not considered to be a selling activity and should be processed as a budget transfer. Refer to Transfer of Funds (Budget Transfer) below for further information.

Processing of Internal Sales

As no cash is exchanged, the appropriate process for internal sales is a general ledger journal entry (GLJE). Units with regular selling activity will use their GLJE user interface to process these transactions. Units with ad hoc sales will submit a GLJE request.

Selling units generally process internal sales revenue to operating funds (F210, F310, F330). Some ad hoc internal sales may occur within restricted research (F530). All units will use Account 401001 - Internal Revenue General.

Internal sales cannot be accrued or deferred, as the university records accruals and deferrals only for external receivables (assets) and payables (liabilities).

Reporting of Internal Sales

On FSGLV12 nVision reports, internal sales appear as revenue to the selling unit and as expenses to the buying unit.

On the university's annual audited financial statements, internal sales revenue is combined with materials, supplies and services expense (i.e. there is no net effect to the university).

Internal Cost Recoveries

Internal cost recoveries occur when a unit pays all expenses as incurred and subsequently allocates an amount to other University of Alberta units (or to research projects) on an infrequent or one-time (i.e. ad hoc) basis in accordance with an agreement. In this case, a sale has not occurred as there is not a fixed fee/price per unit of usage or consumption.

The internal cost recovery process is generally to be used only when there will be multiple expenses (multiple vendors) that cannot be allocated at the outset (perhaps to multiple vendors). This is a relatively rare event, but occurs more commonly among researchers than among units. Wherever possible, expenses that will be shared should be allocated to the appropriate chart of accounts (COA), such as research projects, when processed (e.g. when a purchase requisition is initiated) in order to avoid the need to process subsequent transactions. Where the amount to be charged to other units is not known at the outset, or where multiple expenses are impossible or impractical to allocate at the outset, a cost recovery can be processed.

Note: If making a correction, use the APJV process.

Processing of Internal Cost Recoveries

When determining the amount of expense to be recovered, only the net GST (after the 67% rebate) is to be included, where applicable, as the unit that originally paid the expense should pass on the GST rebate to the unit from whom the expense is being recovered.

Internal cost recoveries are processed as follows:

|

SCENARIO |

PROCESS |

|

Recovery of expenses paid by a single invoice |

Accounts Payable Journal Voucher (APJV) |

|

Recovery of salaries and benefits expenses |

GL Distribution (HCM) |

|

Recovery of multiple expenses where APJV and GL Distribution are impractical |

GLJE request |

Internal cost recoveries are processed to 50xxxx expense accounts within the same fund or between funds. Only expenses that were actually incurred can be recovered (i.e. there cannot be a markup to recover indirect costs, as this would constitute a sale). Supporting documentation must be retained indicating how the amounts being recovered were determined and the approval of all budget owners from whom expenses have been recovered.

Transfer of Funds (Budget Transfer)

Some transactions between units are a transfer of funds, or budget transfer, rather than an internal sale or internal cost recovery.

A transfer of funds occurs when one unit is providing budget support to another for a particular activity. In this case, an internal sale has not occurred as there is no fee-for-service activity, nor is the transaction characteristic of an internal cost recovery as the amount of support is usually based on an estimate of expenses determined in advance of the activity. Furthermore, the expenses should not be allocated to the unit providing support but should remain in the unit carrying out the activity and incurring all the related expenses of the activity.

Budget support includes transactions that units may refer to as "internal sponsorship". The university's definition of sponsorship revenue does not include a contribution received by one university unit from another university unit. Sponsorship revenue is defined in the Sponsorship Procedure as:

A non-university entity provides funding to the university and, in return, receives advertising or promotion of its brand, products or services.

When a university unit makes a contribution to another, the unit providing the funding is not providing advertising or promotion on behalf of the other unit. Therefore, the university does not have account codes for sponsorship revenue in the 401xxx internal revenue range, nor an internal sponsorship expense account. This is processed as a budget transfer.

Correcting Internal Sales and Internal Cost Recovery Transactions

Errors in internal sale and internal cost recovery transactions are processed as follows:

|

SCENARIO |

PROCESS |

|

Error in internal sale/cost recovery where the selling unit used a GLJE user interface and is able to correct through the interface. |

Selling unit corrects through its GLJE user interface

|

|

Error in internal sale where the selling unit used a GLJE user interface but cannot correct through the interface (e.g. Bookstore) |

GLJE request

|

|

Error in ad hoc internal sale / cost recovery processed through GLJE request |

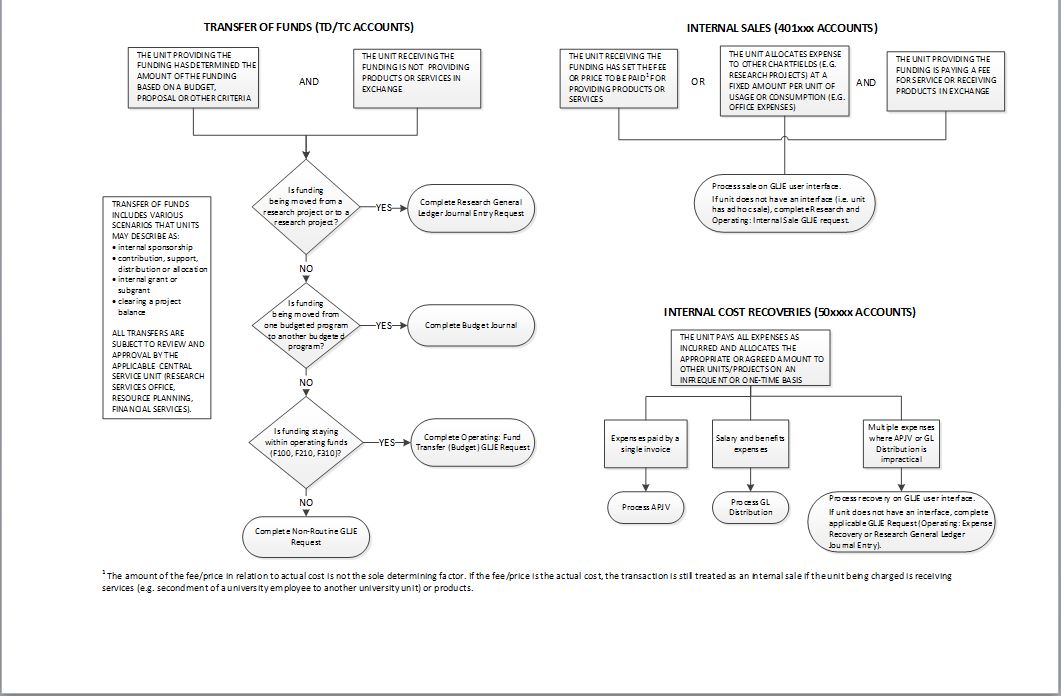

Determining Whether a Transaction is a Transfer of Funds, Internal Sale or Internal Cost Recovery

Refer to the Appendix at the end of this section (Distinguishing Between Transfer of Funds, Internal Sales and Internal Cost Recoveries) to assist with choosing the appropriate transaction process.