Goods and Services Tax (GST) and Harmonized Sales Tax (HST) - External Sales and External Cost Recoveries

The university is subject to federal Goods and Services Tax (GST) and Harmonized Sales Tax (HST) legislation as applicable to external sales and external cost recoveries. Units will determine the appropriate GST coding at the time of processing external sales and external cost recoveries. The purpose of this section is to assist units to process these transactions in accordance with these tax requirements.

As the university is not located within a HST-participating province, the majority of units need only be familiar with the Goods and Services Tax (GST) guidelines. If the external sale or external cost recovery involves goods or services delivered to locations in Ontario, New Brunswick, Newfoundland and Labrador, Nova Scotia or Prince Edward Island, refer to the Harmonized Sales Tax (HST) section.

Questions regarding the applicability of GST and HST to external sales and external cost recoveries should be referred to Finance Services, Shared Services through the Staff Service Centre. For an overview of GST and HST and glossary of related terminology, refer to Guide Chapter 6: Overview of Goods and Services Tax (GST) and Harmonized Sales Tax (HST).

GST on External Sales

GST is required to be assessed on the sale or rental of goods and the provision of services made in Canada to external parties (i.e. external entities, University of Alberta staff, students) who will consume these supplies in Canada. Most of the university's external sales and rentals are taxable (i.e. subject to the 5% GST). Units are responsible for familiarizing themselves with the applicability of GST to their sales activities and customers.

Where the sale or rental is taxable:

- The unit may include GST in their sales prices, or add GST to the price.

- The unit must inform its customers of the GST they are being charged. For cash sales, units must provide customers with receipts that meet Canada Revenue Agency (CRA) GST information requirements (refer to Cash Depositing Procedure). For external billings, units must generate official University of Alberta invoices that meet CRA's requirements. This includes:

- External Billing module or an interface approved by Finance Services in Shared Services. Refer to External Billing Procedure.

- Campus Solutions (for non-credit courses only)

Note: Where the unit is processing an external cost recovery to the operating fund as an external sale and is recovering only the actual amount of the expense net of the GST paid by the unit, refer to the section below titled GST on External Cost Recoveries.

GST codes and common examples relevant to the university's sales activities are shown in the table below:

|

GST CODE |

EXAMPLES |

|

TS (Taxable Sale - 5%) |

|

|

ES (Exempt Sale - 0%) |

|

|

ZS (Zero-Rates Sale - 0%) |

|

|

N (Non-Taxable Sale - 0%) |

|

In addition to the above examples, GST decision trees are provided to assist with the determination as to the appropriate GST assessment. Refer to Links at the end of this section.

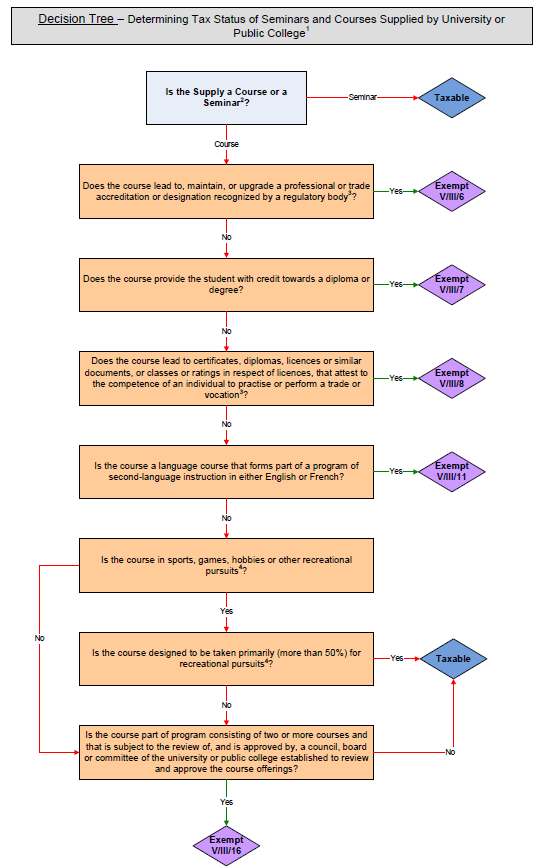

GST on Course Revenue

Depending on the nature of the course being offered, it may be subject to GST (GST code TS). The following decision tree (provided by KPMG) will help determine whether GST will need to be collected.

GST on Customer Refunds

Partial or full refunds to customers on taxable sales must include the appropriate amount of GST that was collected on the sale. There are three methods of refund.

Note: On the Deposit Form, total currency ("Cash Count") cannot be a negative amount.

|

METHOD OF REFUND |

WHEN USED |

PROCESS |

GST CODE |

|

Point-of-sale |

The revenue was collected through the customer's credit card |

The subsequent Deposit Form submitted by the unit should include the reversal of the applicable amounts of revenue and GST |

TS |

|

Currency (bank notes and coins) or debit card |

The unit has sufficient currency on hand to refund the customer |

The subsequent Deposit Form submitted by the unit should include the reversal of the applicable amounts of revenue and GST |

TS |

|

Cheque |

The unit has insufficient currency on hand to refund the customer |

Submit a Payment Request form |

R |

GST on Dishonoured Items and Other Bad Debts

GST legislation allows recovery of GST previously collected and remitted to CRA on bad debt write-offs.

Finance Services in Shared Services processes uncollectible accounts and dishonoured items (e.g. cheques returned by the bank due to stale-date or NSF). When the bad debt write-off includes GST that has been remitted to CRA, the GST will be recovered from CRA. The write-off is processed to the same speedcode as the original entry (account 502571 - Bad Debt), with the GST amount processed to account 202204 - GST Bad Debt Adjustments.

If the unit subsequently recovers all or a portion of the bad debt, it will not deposit the recovery using a Deposit Form, but will submit the Cheque Deposit Information Form. The appropriate GST treatment will be applied by Finance Services in Shared Services.

Example - GST Included in Sales Price

The following example illustrates the appropriate coding of a Deposit Form where the selling unit includes GST in a conference registration fee of $500. The amount of GST is calculated as $500 x 5/105. The Distribution Amount of $476.19 is the revenue portion of the transaction to be processed to the external sales account.

|

Speedcode |

Account |

Distribution Amt. |

Tax Code |

Tax Amount |

Gross Amount (Distribution+Tax Amt) |

|

12345 |

402025 |

476.19 |

TS |

23.81 |

500.00 |

Where the unit is processing an external billing for which the GST is included in the price, it will need to perform the same calculation of the amount before GST to determine the amount to be entered in the Unit Price field, and will apply the TS tax code to the sale.

GST on External Cost Recoveries

For the purposes of GST, external cost recoveries are those costs recovered from external entities, University of Alberta staff and students, on which GST has been paid by the unit. Generally, only costs recovered by restricted funds are processed as external cost recoveries (to 50xxxx expense accounts), while costs recovered by operating funds are processed as external sales (to 402xxx accounts). Refer to External Sales and External Cost Recoveries section for further information.

The overarching concept is that the university is entitled to the GST rebate only for goods and services purchased for its own use; therefore, the net effect of an external cost recovery should be to eliminate the GST rebate received by the university and ensure the external entity is assessed the appropriate GST amount.

GST Coding - Restricted Fund External Cost Recoveries

Cost recoveries to restricted funds are processed through cash deposit or external billing, with GST coding as follows.

|

SCENARIO |

DETAILS |

GST CODE |

|

Recovery of amount up to $100 Note: The external entity will not benefit from the GST rebate received by the university (transaction is too small for the university to adjust its GST). |

|

|

|

Recovery of amount exceeding $100 (refer to example below) |

|

ES |

|

No GST paid (e.g. vendor is not registered for GST) |

|

ES |

The following is an example of the appropriate process for recovery of a large amount. In the original transaction, hospitality expense of $4,000.00, plus 5% GST ($200.00) is charged to a research project. The 67% GST rebate is automatically coded to a receivable account, and the remaining 33% is charged to the expense account (502167 - Hospitality).

|

ACCOUNT |

FUND |

DEPTID |

PROG |

CLASS |

PROJECT |

AMOUNT |

|

502167 - Hospitality |

530 |

410000 |

0 |

0 |

RES0000123 |

4,066.00 |

|

100802 - GST Receivable |

530 |

410000 |

0 |

0 |

RES0000123 |

134.00 |

The cost recovery will be processed as if the above transaction is being reversed. The Deposit Form or external billing will be processed by the unit as follows:

|

ACCOUNT |

FUND |

DEPTID |

PROG |

CLASS |

PROJECT |

AMOUNT |

TAX CODE |

|

502167 - Hospitality |

530 |

410000 |

0 |

0 |

RES0000123 |

(4,066.00) |

ES |

|

100802 - GST Receivable |

530 |

410000 |

0 |

0 |

RES0000123 |

(134.00) |

ES |

GST Coding - Operating Fund External Cost Recoveries

Refer to External Sales and External Cost Recoveries for determining how to process cost recoveries according to the underlying scenario. In the limited circumstances where the recovery is to be processed as to an expense account (50xxxx), follow the procedures related to restricted funds (above).

Most operating fund external cost recoveries are processed as external sales (i.e. coded to 402xxx accounts). The appropriate GST coding depends on whether the unit charges direct cost or less than direct cost. Direct cost is defined (in the Excise Tax Act) as:

.. the consideration paid to a supplier for the purchase of a supply of tangible personal property or a service less any rebated or refunded taxes. The direct cost will also include the consideration paid for any related supplies that are incorporated into or is to form a constituent or component part of the property, or is consumed or expended directly in the process of manufacturing, producing, processing or packaging the property.

|

SCENARIO |

GST CODE |

|

Unit charges the external entity the exact cost incurred, net of GST rebate (if applicable), or less than the exact cost |

ES |

|

Unit charges the external entity more than actual cost (e.g. including a profit or recovery of administrative costs) Note: The unit may be able to claim input tax credit (ITC) on its purchases. Refer to Chapter 10: Procurement for GST information. |

As applicable to the goods or services being sold (refer to GST Assessment above) |

GST Corrections

Errors and omissions in the assessment and collection of GST and any subsequent penalties and/or interest are the unit's responsibility.

If the unit subsequently discovers an error, it must either make the additional effort to collect the GST from the customer or process a correction. Errors in cash sales are corrected through the Cashier Deposit Correction Form. Errors in billings are corrected through the Billing module.

Harmonized Sales Tax (HST)

HST is a blend of the federal 5% GST and the applicable provincial sales tax on sales of goods and services supplied to and consumed within the participating provinces of Ontario, New Brunswick, Newfoundland and Labrador, Nova Scotia or Prince Edward Island. The HST rate varies by province. Refer to the Canada Revenue Agency website for current rates.

When processing a billing or cash sale to which HST is applicable, the unit will need to manually calculate and enter the HST amount. The following example illustrates the appropriate coding of a billing where the selling unit includes HST in a conference registration fee of $500 where the conference is held in Ontario, which has an HST rate of 13%.

|

HST included in conference registration fee |

$500 x 13/113 = $57.52 |

|

Unit price |

$500 - 57.52 = $442.48 |

|

Tax code |

HST |

Although the applicability of HST is generally similar to GST, the regulations vary from province-to-province. Units should contact the Staff Service Centre if they will be delivering products or services to a customer located in one of the HST-participating provinces.

Links:

GST/HST Rates by Province (Canada Revenue Agency)

Decision Tree: External Supplies (Sales) of Products, Services & Personal Property (pdf)

Last Updated: March 2016