TCI Energy Brief: Early TMX Pipeline Expansion Data Reveals China’s Emerging Role as a Significant Buyer of Canadian Crude, Offering Some Diversification From the U.S. Market

Completion of the Trans Mountain Pipeline Expansion (TMX) project in May 2024 marked a transformative moment for Canada’s crude oil industry, increasing the amount of oil that can make it to tidewater, and unlocking significant new export opportunities. Contrary to many analysts’ expectations, early data indicates that a large amount of this new export capacity is finding its way not to California’s refineries, but rather to China. This marks a noteworthy shift from Canada’s almost complete reliance on the United States as its predominant oil customer - a shift all the more timely given the context of recent travails in the Canada-U.S. bilateral relationship.

This brief highlights several implications that flow from Canada’s newfound ability to get significant quantities of Alberta crude to tidewater, and from China’s willingness to pay a higher price. These include the expanded capacity for Canada to reduce its critical overdependence on the US as a sole customer, the knock-on effect of oil export diversification leading to a higher price per barrel for Canadian crude, and the prospect of Canada establishing itself as a reliable and significant supplier of crude to China and the broader Indo-Pacific region. This emerging reality also offers newfound leverage for Canada as it faces growing uncertainty with respect to its trading relationship with its southern neighbour.

The TMX pipeline: Current state of play

The coming online in May of 2024 of the TMX pipeline nearly triples the quantity of crude oil that can be exported from Canada’s Pacific coast, from 300,000 barrels per day (bpd) to 890,000 bpd. While the US continues to be Canada’s chief customer for oil exports in the aggregate, with purchases of some 4 million bpd, early data indicates that the TMX pipeline enables Canada to become a significant oil supplier to the Indo-Pacific, with China the largest regional importer by far. In the period of May 2024 to November 2024, China purchased C$2.03 billion worth of crude from Canada, whereas before it imported virtually no crude directly from Canada. While these are early days and more time will be needed to draw a clearer picture, the trend is clear: China now regularly accounts for 50% or more of all crude exported from the TMX pipeline. The largest single purchaser of Canadian crude oil shipped abroad via the TMX pipeline is Rongsheng Petrochemical, a Chinese firm that owns and operates many expansive and sophisticated refineries on China’s east coast, including an 800,000 bpd refinery in Zhejiang province. In sum, while the US remains the largest market for Canadian crude oil, the TMX pipeline has facilitated China’s rise as a major buyer of Canadian crude, enabled higher prices per barrel for its exports from the Pacific coast, and broken the monopsony commanded by the US in Canada’s oil sector.

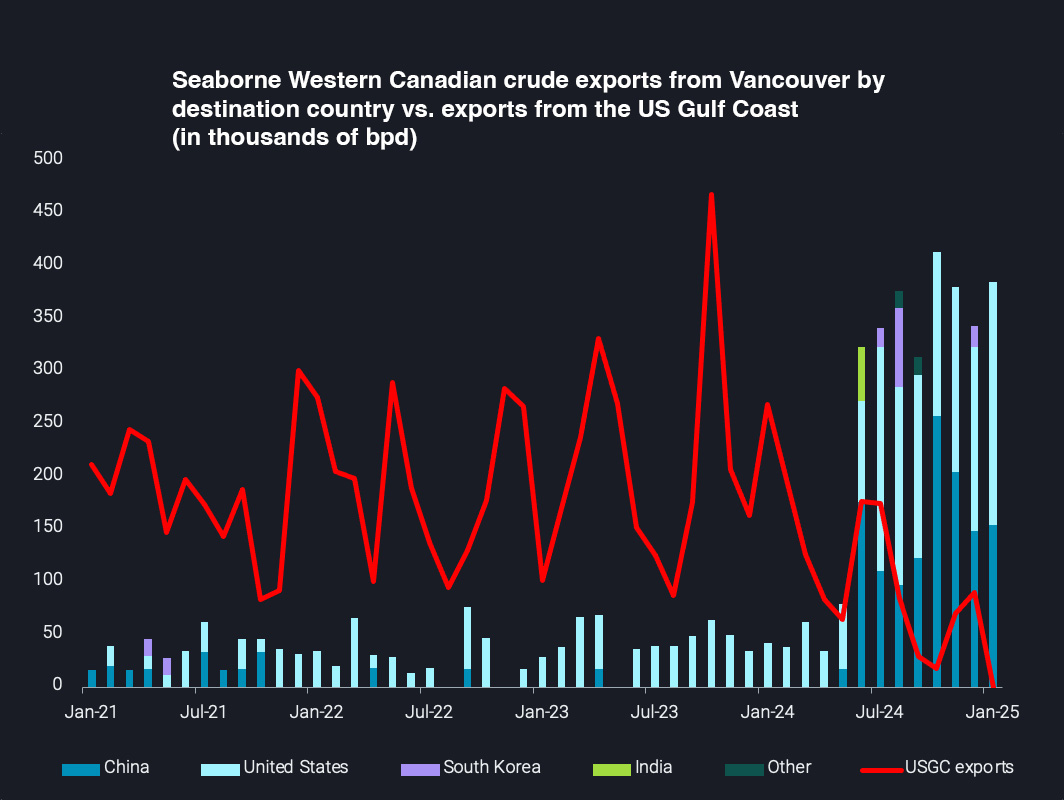

This is contrary to the predictions of many analysts, who expected that oil transported from Alberta to the Pacific coast via the new TMX pipeline would simply lead to Canadian crude being shipped in greater quantities to American refineries in California. The significant shift in Canadian crude export flows is illustrated below in data provided by Vortexa senior oil market analyst Rohit Rathod, highlighting that Canadian crude exported beyond North America is now being shipped from Canada’s West Coast as opposed to via the US Gulf Coast. The emerging demand for Canadian crude in China is also reflected in the resulting displacement of other similar varieties of heavy crude, including from several Middle Eastern sources. Indeed, the status of Canadian oil as the cheapest non-sanctioned crude on the market available today has encouraged many of China’s largest oil companies to view Canada as an important and, from a risk perspective, geopolitically desirable new source of imports to use as feedstock in their refineries.

Source: Vortexa

Positive knock-on effects for the price of Canadian oil

Canadian oil has historically been cheap on a per-barrel basis, mainly as a function of its lower physical quality and its reliance on a single customer. This has in the past led to Canadian crude trading at a deep discount relative to the West Texas Intermediate (WTI) benchmark when sold to US refiners. Estimates point to oil producers being able to receive approximately $5.00-$6.00 more per barrel brought to tidewater when compared to exports to the American Midwest or US Gulf Coast, including for crude exported not only to Asia but also by sea to US refineries in California. This significant upside means that Canadian crude that makes it to tidewater is markedly more profitable than that shipped to the US by non-sea routes. Canada’s ability to export crude to a broader range of countries may also, over time, lead to increases in the per-barrel price of Canadian oil across the board.

Reduction of Canadian economic overdependence on the US, and enhanced diplomatic leverage going forward

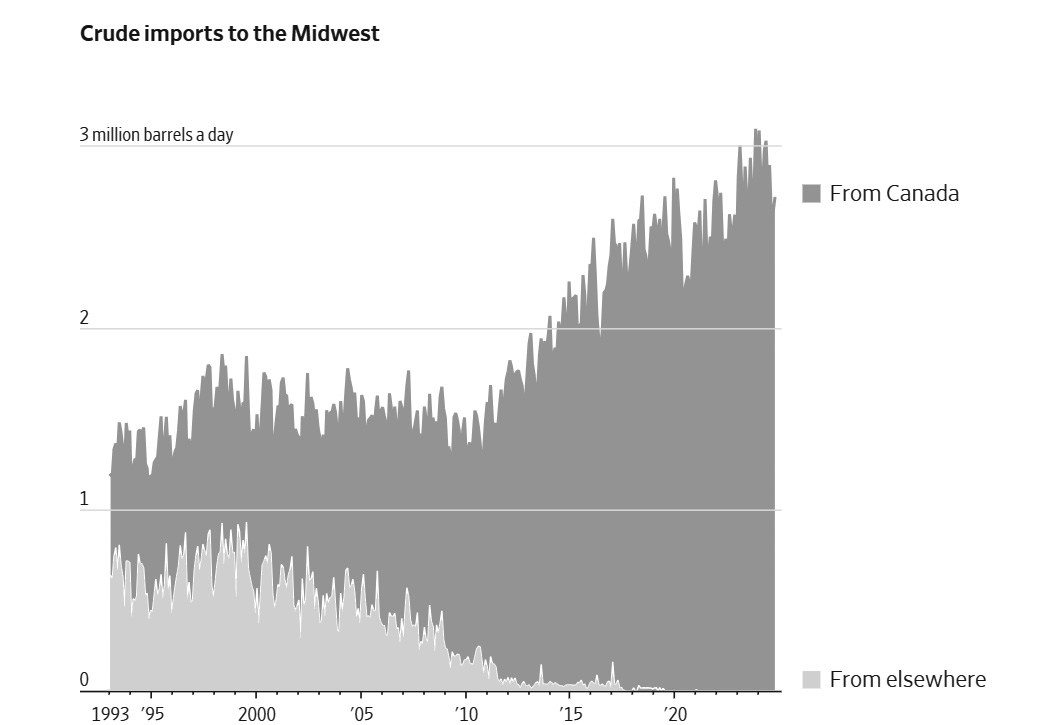

In 2023, prior to the TMX project’s completion, Canada exported C$130.33 billion in oil to the US, accounting for 97% of total Canadian oil exports and nearly one-fifth of Canada’s total exports to all countries. With the ability to now move close to 1 million BPD from its Pacific coast, Canada’s status as holder of the world’s third-largest oil reserves and as the world’s fifth-largest oil exporter, puts Ottawa in a somewhat better position when negotiating with the newly-inaugurated Trump administration. This is all the more the case given how reliant a wide cross-section of U.S. refineries are on Canadian crude oil inputs. Even in a scenario where the U.S. increases its sources of domestic supply at Canada’s expense, the cost of converting refineries originally built to process heavy, sour Canadian crude towards processing light, sweet American crude is very significant. This strengthened hand that Canada now has to play is highlighted below:

Source: The Wall Street Journal

From a diplomatic perspective, increasing Canada’s ability to export oil to tidewater represents a dual advantage: it strengthens Ottawa’s position in its dealings with Washington while simultaneously enhancing Canada’s diplomatic relevance and influence in the Indo-Pacific region. Viewed through this prism, one could argue that the TMX pipeline expansion is a key enabler helping to advance many of the objectives of current Canadian foreign policy, including many of those articulated in Ottawa’s 2022 Indo-Pacific Strategy.

Complementarity between Canadian supply and Chinese demand

Beyond the reality of Canada being a major oil producing country and China’s status as the world’s largest net oil importer, other structural factors point to significant potential for Canada to become a reliable long-term supplier of crude to China. Firstly, the physical constitution of Canadian oil is well-suited to Chinese refineries, which are overwhelmingly configured to process similar heavy and sour crudes. Other refineries in the Indo-Pacific region, which are similarly configured, also have the potential to benefit from Canada’s oil exports. In addition, Canada provides a geopolitically appealing option to bolster the region's overall energy security, especially when compared to reliance on other major oil producers. For instance, the volatile security dynamics in the Middle East and, in China’s case, concerns regarding overdependence on Russian energy highlight the value of diversifying supply sources.. This is further magnified by Canadian oil in transit to most of the region not being subject to precarious maritime chokepoints like the Strait of Hormuz and Malacca Strait, a long-standing concern regarding the reliability of oil imports from the Middle East. Finally, Canadian oil remains unlikely to be the object of US sanctions: as recently as this month, the threat of being subject to secondary US sanctions for accepting sanctioned oil has caused many oil refineries in China to stop purchasing Iranian oil.

This alignment between Canadian and Chinese interests when it comes to TMX-sourced crude would seem to point to a trading arrangement able to transcend any future cycle of ups and downs in the bilateral relationship. One could also expect that, as an increasingly significant supplier to China of a critical energy security input, Canada’s diplomatic relevancy and traction within the Canada-China bilateral relationship would be enhanced.

Challenges moving forward

On the Canadian domestic side, there are two main obstacles that have prevented the TMX pipeline from reaching its fullest potential in terms of transit capacity. Firstly, infrastructural limitations at the Port of Vancouver, where oil exports from Canada to the Indo-Pacific are shipped from, have acted as a barrier to large maritime transport vessels collecting cargoes for shipment overseas. Secondly, the TMX pipeline’s toll prices, which are charged to oil producers who use it to export crude, are currently relatively high, incentivising some crude to continue to be shipped overland to the US in large quantities. The deleterious effect of these high toll prices is likely the main cause explaining why the TMX pipeline is still consistently utilized below capacity, while pipelines going to the US Midwest, such as the Enbridge Mainline, are concurrently running close to full bore.

Charting the path ahead

The TMX pipeline's strategic implications are particularly salient in the face of shifting geopolitical dynamics, where Canada's economic ties with both the US and China face potential volatility, as well as some opportunities. A backdrop of rising US economic nationalism, and President Donald Trump's combative rhetoric, highlight the need for Canada to diversify its energy export markets and strengthen its global economic resilience.

While China’s oil demand may be approaching its historical peak, its key role as a driver of global energy consumption and trade still underscores the importance of Canada’s engagement with Chinese markets. As Beijing transitions toward renewable energy domestically, its refineries will continue to meet substantial demand from developing nations, ensuring that oil remains a critical component of China's energy landscape for the foreseeable future. Furthermore, despite the deceleration in domestic Chinese oil demand growth amid the country's transition to renewable energy, domestic demand is expected to remain robust for years to come. In addition, given the fungible nature of crude oil exports, and thanks to the compatibility of Alberta crude with oil refineries across the Indo-Pacific, any future tensions with China would not preclude Canada from rapidly pivoting to other purchasers in the region - largely insulating it from the possibility of coercive trade practices when it comes to its exports of oil to the region.

The China Institute at the University of Alberta will continue to monitor this emerging trend as a richer data set emerges - and geopolitical developments continue to evolve - over the coming months.

Authors

Daniel Lincoln

Policy Research Analyst

Daniel is a graduate of the University of Alberta, holding a BA With Distinction in Political Science, Economics, and History. His main research interests include Canada-China trade, Chinese investment patterns abroad, China's role as an emerging leader of the Global South, and Canada's engagement with the Indo-Pacific region broadly.

Philippe Rheault

Director

Philippe Rheault is the Director of The China Institute at the University of Alberta, following a 25-year career in the Canadian foreign service with a primary focus on China and East Asia.

Anton Malkin

Head of Research

Anton Malkin holds a PhD in Global Governance from the Balsillie School of International Affairs and is a distinguished expert in academic and policy-oriented research on China. His research focuses on China’s financial system, industrial policy, technological innovation, and its role in global governance.