Balancing Challenge with Opportunity: Assessing the Economic Impact of China's Potential CPTPP Membership on Canada and Beyond

As Canada prepares to chair the upcoming CPTPP Commission meeting later this month in Vancouver against the backdrop of a deteriorating global trading order, the salience of the CPTPP as a modern and effective trading regime has never been greater. Among the items on the November meeting’s agenda is a key question: how should member states respond to China’s formal request to begin accession talks? This issue has sparked a lively and ongoing policy debate, with compelling arguments on both sides. To contribute to this discussion, this report delves into the data, aiming to quantify a crucial question: What would be the economic impact of China’s eventual membership on current CPTPP members?

Preamble

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) stands as one of the most ambitious and modern trade agreements in existence today. Emerging from the ashes of the Trans-Pacific Partnership (TPP) but now without its most important early architect the United States, the CPTPP not only reflects a pivot toward addressing contemporary trade challenges—such as labor, environmental standards, intellectual property, and digital trade—but also serves as a critical framework to counterbalance rising trends of trade fragmentation and protectionism.

In recent years, the question of whether China should be invited to join the CPTPP has sparked robust policy debates. These discussions center on competing narratives: on one hand, skepticism persists over China’s track record with international trade commitments, particularly under the WTO framework, and its use of coercive economic measures. On the other hand, proponents argue that the CPTPP’s accession process and higher standards could encourage reforms and ensure greater adherence to global trade norms. As global trade continues to fragment and WTO reforms remain elusive, even imperfect adherence to a rules-based framework like the CPTPP might represent a better alternative to an unregulated status quo.

Relatedly, consideration could be given to extending an invitation to China conditional on the simultaneous commencement of CPTPP accession talks with Taipei. Such an approach could serve as a catalyst for promoting balanced participation across both sides of the Taiwan Strait while reinforcing the CPTPP’s commitment to inclusivity and adherence to high standards for all potential members.

While these debates are essential, they have largely unfolded in the absence of hard data to inform policymakers. What has been missing is a clear empirical assessment of the economic implications of China’s potential membership, particularly for existing members such as Canada. This gap is critical given that Canada is poised to chair the next CPTPP accession committee meeting later this month in Vancouver—a moment that offers a timely opportunity to shape the future of the agreement.

This report aims to address that void by providing a detailed, data-driven evaluation of the economic impacts of China’s potential accession, with a particular focus on trade in goods. Through in-depth analysis, including simulations conducted using the World Bank’s SMART tool, the findings reveal a net benefit for existing members, with Canada and Japan among the biggest potential winners. The results highlight the tangible economic opportunities that could arise, while also acknowledging the broader systemic and political questions that remain unresolved.

For those interested in trade policy or the broader trajectory of global trade, this report offers a foundation for further reflection. It does not seek to prescribe whether Canada or other members should endorse China’s bid for membership but rather to equip policymakers with evidence to consider alongside strategic and political factors. As debates on China’s accession evolve, we invite readers to engage with our findings and consider the balance of opportunities and risks this potential expansion presents.

Executive Summary

This report evaluates the economic impacts of China’s potential accession to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), focusing on Canada’s trade interests. Using simulations from the World Bank’s SMART tool, the analysis demonstrates significant economic benefits for Canada, including a projected 15% increase in exports to China, translating to a $6.5 billion boost in economic output. Key sectors like meat, grains, and energy would see notable growth, with Alberta positioned as a major beneficiary. Additionally, Canada would experience a 1.8% reduction in its trade deficit with China, emphasizing the strategic potential of this partnership to diversify Canada’s trade relationships and reduce economic reliance on the United States. The inclusion of China is forecasted to generate substantial trade creation, improved social welfare, and minimal trade diversion impacts for Canada, highlighting the mutual advantages of China joining the CPTPP.

Assessment of the Economic Impacts on Canada of China Joining CPTPP

In light of growing geopolitical tensions, doubts about the WTO’s effectiveness, and increasing fragmentation in international trade, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) emerges as a pivotal framework that promotes trade integrity and liberalization with multilateral benefits. Thanks to its high standards and modern, enforceable design, the CPTPP serves as a counterweight to the rising trends of protectionism and unilateralism in global trade.

Although maintaining and expanding the CPTPP may not currently dominate the Canadian policy agenda, debates surrounding China’s overcapacity in manufacturing and its expanding trade surplus with key partners make it imperative for Ottawa to address competition and market distortions arising from China’s trade practices.

As China signals a strong interest in joining the CPTPP, concerns persist about its ability to adhere to the agreement’s stringent standards, its regulatory transparency, and its record of compliance with WTO commitments. These concerns, however, should be weighed against the tangible economic benefits for Canada, particularly given Canada’s heavy reliance on the United States for trade. The CPTPP, with its high ambition and inclusive rules, provides Canada with a crucial opportunity to diversify trade relations and enhance resilience.

Trade between Canada and China has already demonstrated resilience, even amidst high tariffs and political tensions. This suggests considerable potential for growth if trade barriers are reduced. Moreover, the complementary economic structures of Canada and China—with strengths in agriculture, energy, and industrial sectors—should position both nations to benefit from closer trade ties.

By focusing on quantitative data, this report seeks to provide policymakers with an empirical analysis of the practical economic impacts of China’s accession to the CPTPP. It aims to offer an evidence-driven foundation for evaluating the potential trade-offs and opportunities, moving beyond rhetoric to focus on measurable outcomes.

Summary of Results

Utilizing the Software for Market Analysis and Restrictions on Trade (SMART) Simulator via The World Integrated Trade Solution (WITS) of the World Bank, the analysis reveals substantial economic advantages for CPTPP members, and notably Canada, if China were to join.

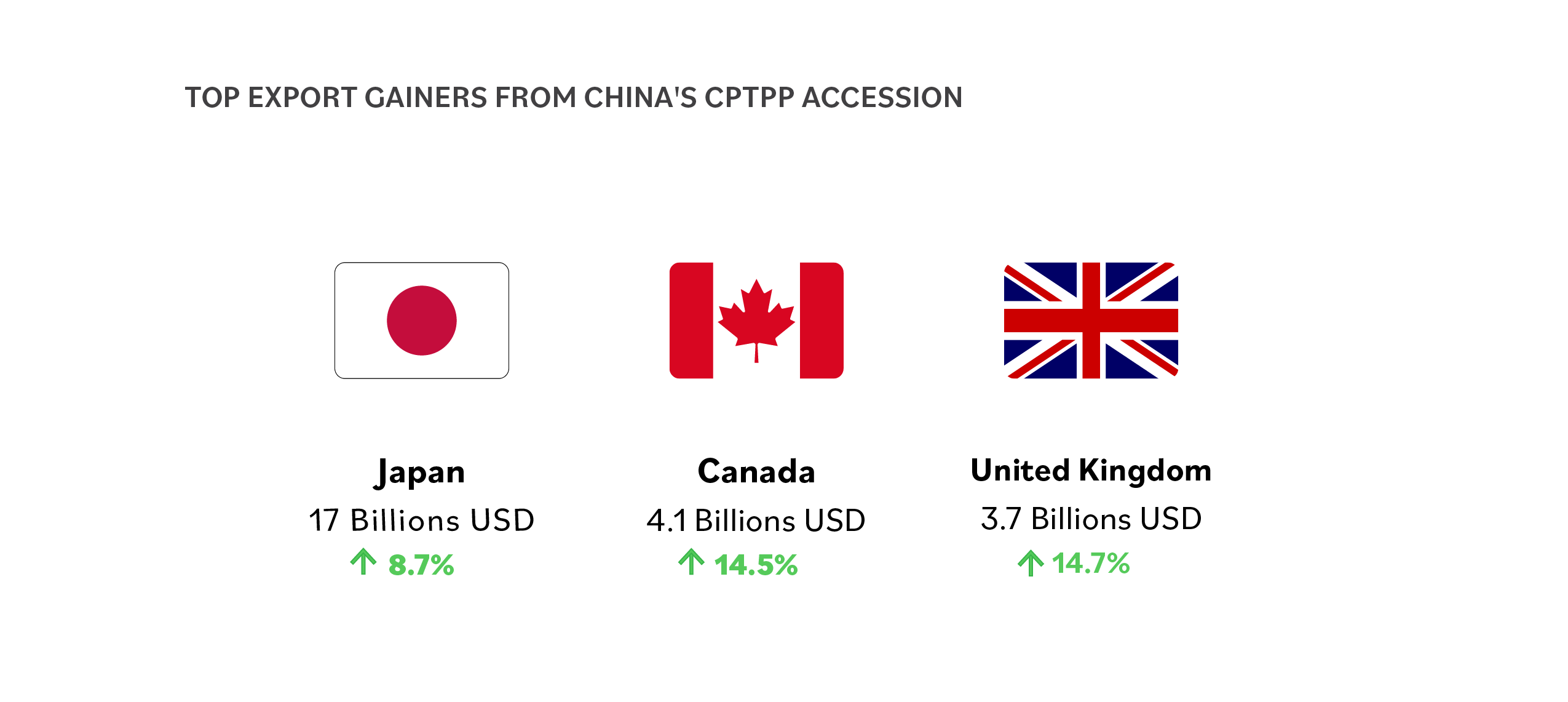

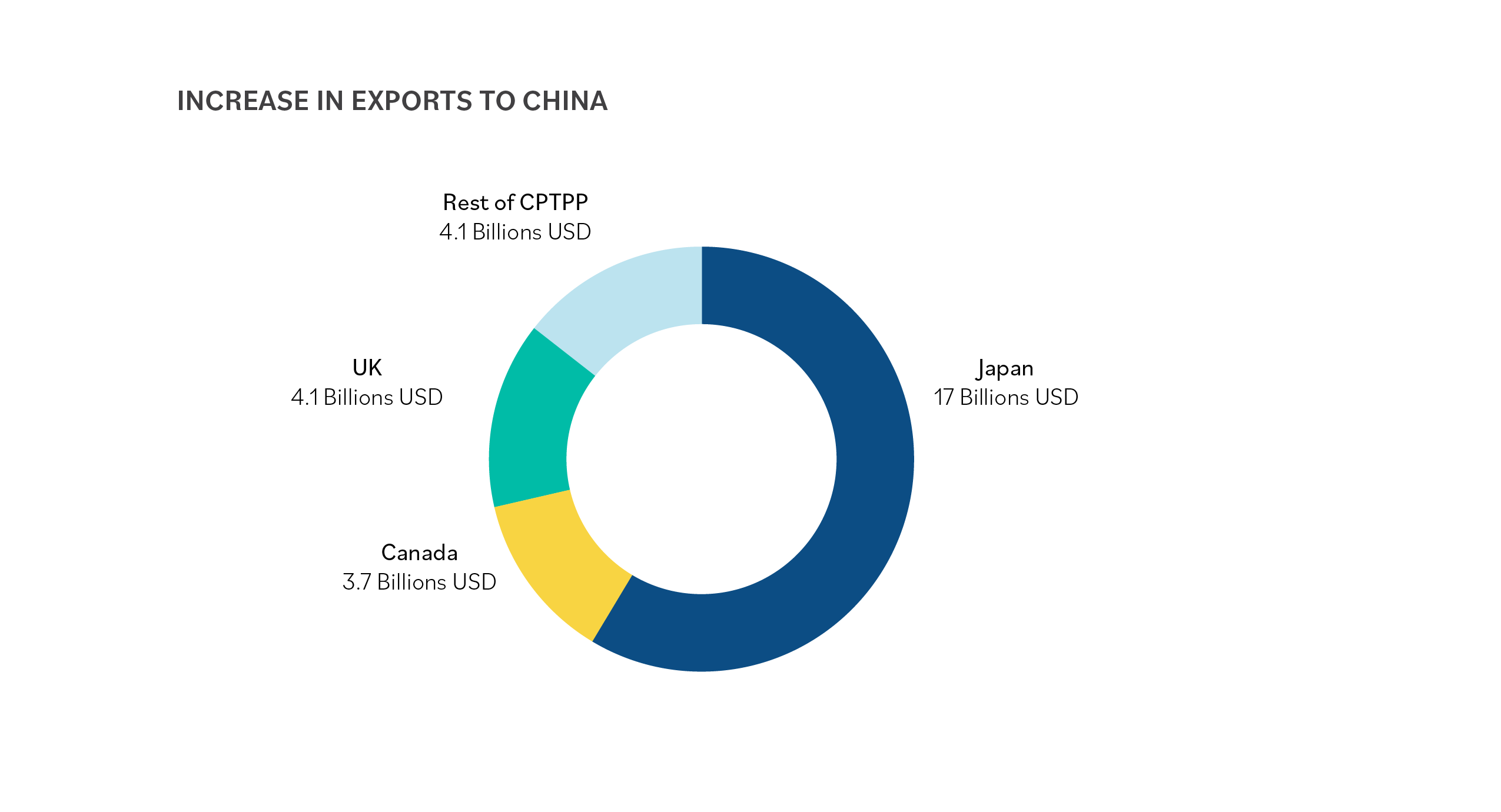

China’s inclusion would boost total exports from all CPTPP members to China by US$28.9 billion, representing a 4% uptick and highlighting the strategic value of expanded market access. Of this increase, US$18.7 billion constitutes new trade creation, reducing economic inefficiencies and contributing to global trade dynamics . Canada, Japan, and the UK are projected to see the largest export gains to China, with minimal trade diversion effects. Notably, Canada is uniquely exempt from negative trade diversion, highlighting its advantageous position within the CPTPP framework.

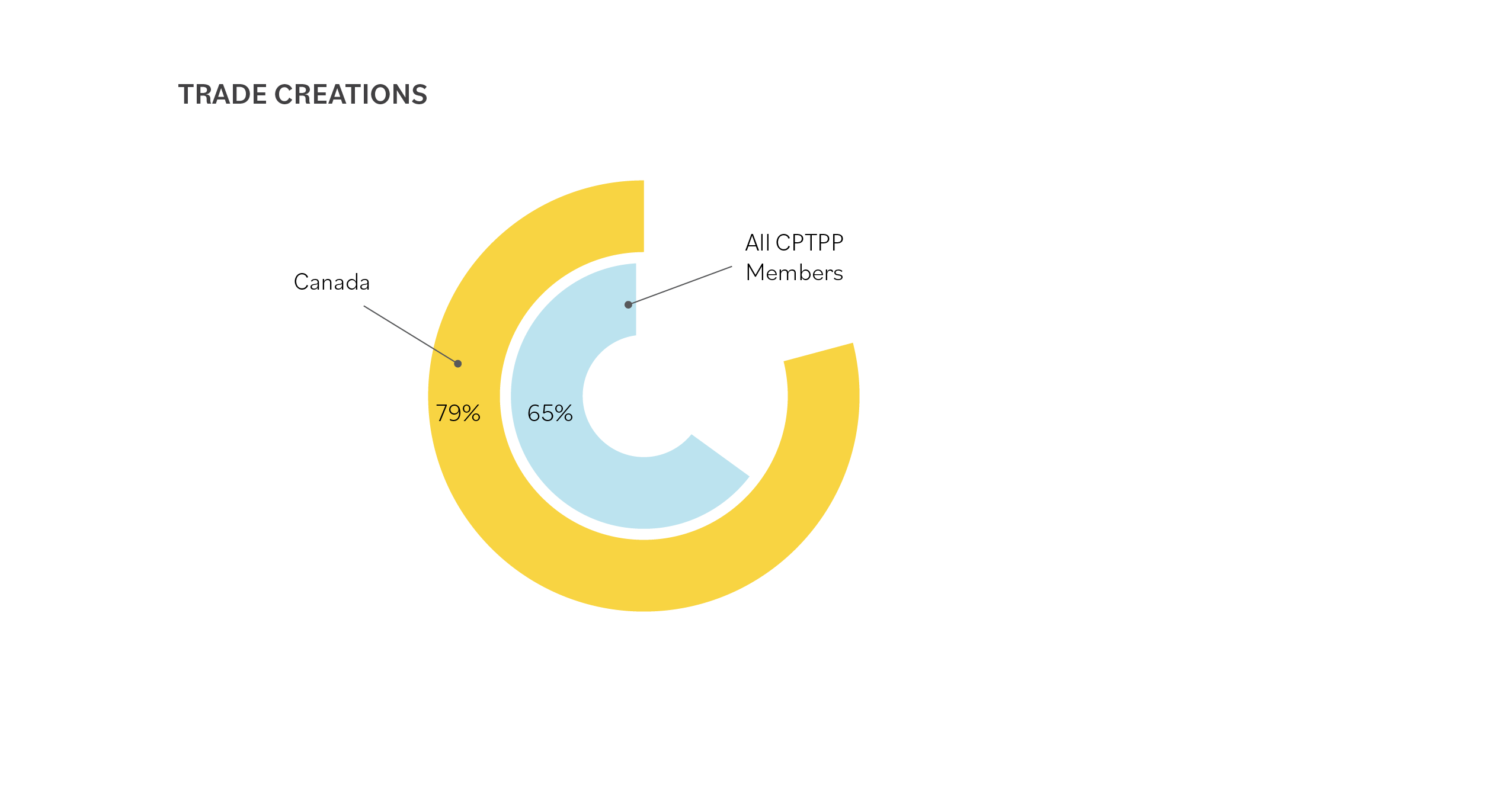

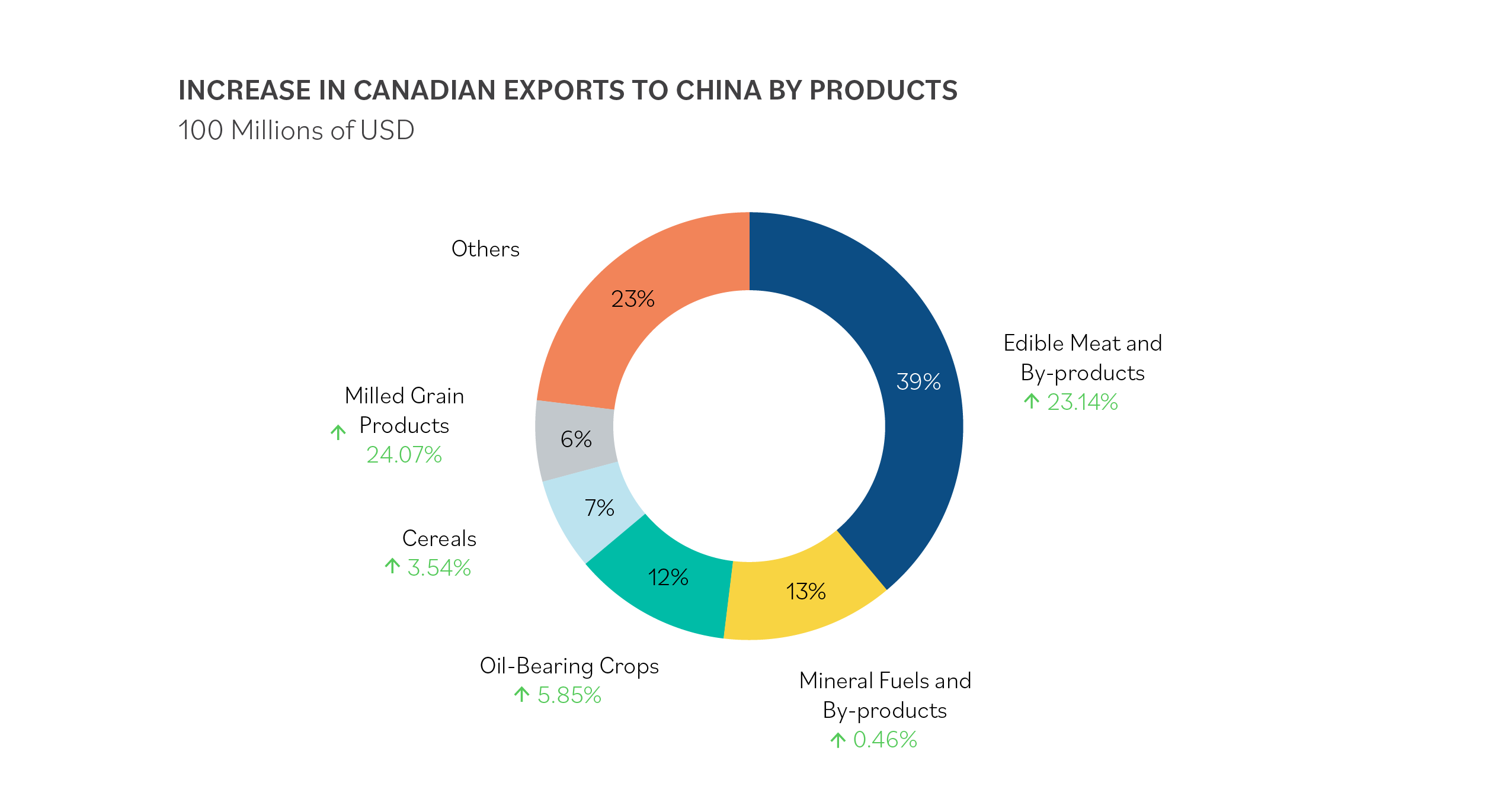

For Canada, simulations suggest that exports to China would increase by 15%, representing 14.3% of the total export gains to China by all CPTPP members. The incremental export increase of US$4.1 billion corresponds to a broader economic output increase of US$6.5 billion, according to Statistics Canada multipliers. Crucially, 79% of Canada’s trade increase is attributable to new trade creation, signaling genuine market expansion rather than redistribution among existing partners.

Key sectors such as meat products (HS02) and grain-based products (HS11) would benefit significantly from China’s tariff removal, together accounting for 47% of Canada’s total export gains in these categories. Alberta, in particular, stands to gain as a major beneficiary, with strong growth in farming and energy exports also likely. This diversification would help Alberta balance volatile oil prices, create new jobs, and attract investment.

The welfare implications for Canada are equally significant. Without China in the CPTPP, the trade creation effect for Canada is modest, estimated at US$233 million, with a total welfare impact of US$11.1 million. However, China’s inclusion could increase these figures tenfold, with US$2.4 billion in trade creation and US$110.8 million in welfare effects. These benefits underscore the opportunities that could flow from integrating China into a structured trade framework that ensures sustainable, rules-based liberalization.

Mitigating Risks through Enforcement

While the data clearly highlights economic benefits, this report also acknowledges the systemic concerns associated with China’s accession. Canada and other CPTPP members must emphasize enforceable standards to mitigate risks stemming from non-tariff measures and politically motivated trade policies. The CPTPP’s robust mechanisms for transparency and dispute resolution offer the best currently available framework to address these challenges, working to ensure that economic gains are not undermined by non-compliance.

For the data analysis used in this research, please refer to this document.

Authors

Xiaowen Zhang

Postdoctoral Research Fellow

Xiaowen holds a PhD in Finance, specializing in Financial Economics, with expertise in corporate investment, governance, and institutional investors. Her corporate-level research lays the micro foundation for her policy work on international economic relations, particularly Canada-China trade, investment, and China’s economic development and policy dynamics.

Philippe Rheault

Director

Philippe Rheault is the Director of The China Institute at the University of Alberta, following a 25-year career in the Canadian foreign service with a primary focus on China and East Asia.

Anton Malkin

Head of Research

Anton Malkin holds a PhD in Global Governance from the Balsillie School of International Affairs and is a distinguished expert in academic and policy-oriented research on China. His research focuses on China’s financial system, industrial policy, technological innovation, and its role in global governance.