Canada-China Trade: 2023 Year in Review

Daniel Lincoln - 11 June 2024

This 2023 bilateral trade report seeks to provide a combination of thoroughly described trade data and analysis of broader economic and political trends that drive quarterly developments, aiming to offer a unique insight into Canada-China trade dynamics. As Canada’s engagement with China becomes ever more complex and multifaceted, this analysis is one tool for examining how our relations with China evolve over time, and the important place that trade occupies in the bilateral relationship.

Following the end of disruptions caused by COVID-19 in both Canada and China, both countries’ uneven economic recoveries in 2023 led to volatility and fluctuations in bilateral trade throughout the year. In Canada, high interest rates led to subdued consumer confidence, which in turn has adversely affected Canadian demand for Chinese goods. The Chinese economy’s strong start at the beginning of 2023 was reflected in substantial gains for Canadian exports to China, but as economic challenges surfaced in China throughout the remainder of the year, the flow of Canadian exports to China became more volatile from month-to-month. The unpredictable macroeconomic environment in China also led to 2023 recording the lowest level of foreign investment flows into the country since 1993. These macroeconomic headwinds occurred amidst an environment of geopolitical tensions between Canada and China, which served to further aggravate uncertainty in the bilateral trade relationship.

Looking forward to Canada-China trade in 2024, uncertainty stemming from a multitude of factors will continue to affect the bilateral flow of goods. The bilateral flow of goods in 2024 will likely be contingent on the economic performance of both countries and the presence of diplomatic tensions, in addition to broader global developments that could influence the trade relationship. Nevertheless, despite ongoing economic and diplomatic challenges, it is worth noting that bilateral trade flows remain near record levels.

Year-End Data

The Canada-China trade relationship was surprisingly volatile throughout 2023, which occurred in tandem with both countries' economic downturns and ongoing geopolitical tensions. The year started off with both Canadian imports from China and Canadian exports to China on a somewhat positive trajectory, before both became subject to month-to-month fluctuations for the remainder of the year. As a result, the two countries’ trade balance was similarly erratic, although notably Canada’s monthly trade deficit reached a 24-month low-point in December 2023.

Indeed, despite this volatility, 2023 export and import numbers exceeded those in 2019 before the pandemic, although total trade was still below the historic high of 2022. Adjusting for inflation, 2023 exports reached $30.50 billion, outperforming $27.58 billion of exports in 2019; likewise, Canadian imports from China were valued at $89.21 billion in 2023, compared with $88.87 billion in 2019. This real growth in trade relative to pre-pandemic levels is potentially indicative of the fact that, despite ongoing volatility, trade disruptions stemming from COVID-19 have largely abated this year.

The contents of the 2023 Year in Review Canada-China Trade Report are as follows:

- Canadian Exports to China An overview of Canadian exports to China in 2023, with a focus on the top exported products.

- Canadian Imports from China An overview of Canadian imports from China in 2023, with a focus on the top imported products.

- Canada-China Trade: A Two-Year Perspective An analysis of the prevailing macro trends in bilateral trade over the course of the last 24 months preceding December 2023.

- Provincial Data An overview of bilateral trade between all Canadian provinces and territories with China.

- Trends and Topics A qualitative analysis of possible factors influencing Canada-China trade flows in 2023, and the highlighting of factors that could potentially affect bilateral trade in 2024.

The following draws on Statistics Canada data for goods (merchandise) trade with China, presented on an unadjusted customs basis in Canadian dollars (CAD). The relevant HS 4-digit identification codes are used to identify product groups. All values are in Canadian dollars (CAD).[1]

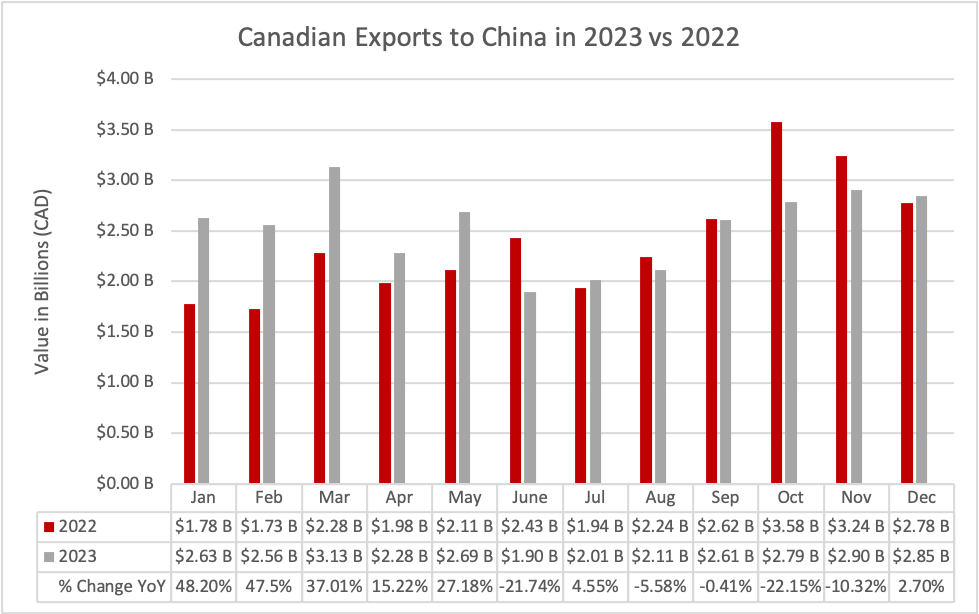

1. Canadian Exports to China

Continuing a trend noted throughout 2023, the year ended with Canadian exports to China increasing by 6.17% YoY, contrasting with a concurrent contraction of 1.56% in exports to all countries overall. The total value of Canadian exports reached $30.50 billion for 2023, which, adjusting for inflation outperformed the last five years of Canadian exports to China. In comparison, Canadian exports to our largest trading partner, the United States, contracted by 0.73% YoY in 2023, although their total value continues to dwarf that of exports to China, amounting to $594.99 billion.

Although Canadian exports to China have been a bright spot throughout 2023 as overall exports to other countries have contracted, it is worth noting that their rate of growth has slowed consistently quarter-over-quarter throughout the year. In Q1 2023, Canadian exports to China grew by 44.21%, followed by 23.85% in Q2, 14.80% in Q3, and finally 6.17% by the end of Q4. This means that the overall performance of Canadian exports to China in 2023 was significantly buoyed by strong growth from January-May 2023 (likely driven by China’s lifting of pandemic restrictions), as every month following May exhibited a decrease in exports, with the exception of July and December. However, even these months saw relatively small YoY growths of 4.55% and 2.70%, respectively, a far cry from the double-digit growth seen consistently in the first five months of 2023.

Source: Trade Data Online (Statistics Canada – Customs Data)

In 2023, the top Canadian export to China was canola[2], which reached a total value of $3.84 billion and experienced an impressive growth rate of 75.21% YoY. The expansion of Canadian canola exports to China was likely driven by increased consumer spending following the end of COVID-19 restrictions, particularly at the beginning of 2023, in addition to a normalization of market access conditions for Canadian producers. The second-largest product category exported to China was coal[3], amounting to $3.04 billion while contracting by 12.93% annually. Canadian coal shipments to China were down consistently throughout 2023, which could have been partially caused by China’s decision to lift import restrictions on Australian coal following improved diplomatic relations between Canberra and Beijing. Iron[4] ranked as the third-largest Canadian export to China, growing by 15.58% YoY and totaling $2.52 billion. The fourth-largest Canadian export to China in 2023 was chemical wood pulp[5], accounting for $2.21 billion and expanding by a modest 1.98% YoY. Finally, exports of copper[6] to China showed a robust 13.57% YoY growth rate and added up to $1.58 billion, positioning it as the fifth-largest Canadian export to China.

The mix of major Canadian exports to China in 2023 illustrates that Canada remains a key supplier of commodities to China, which has been the historic norm for the Canada-China trade relationship. Indeed, manufactured goods do not even rank in the top 10 products exported by Canada to China. While the reduction in coal exports is likely reflective of competition from other major coal-producing countries such as Mongolia, Russia, and Australia, the expansion of exports of other important resources such as copper demonstrate that Canada plays a significant role in facilitating some of Beijing’s primary goals, including the building up China’s of industrial capabilities.

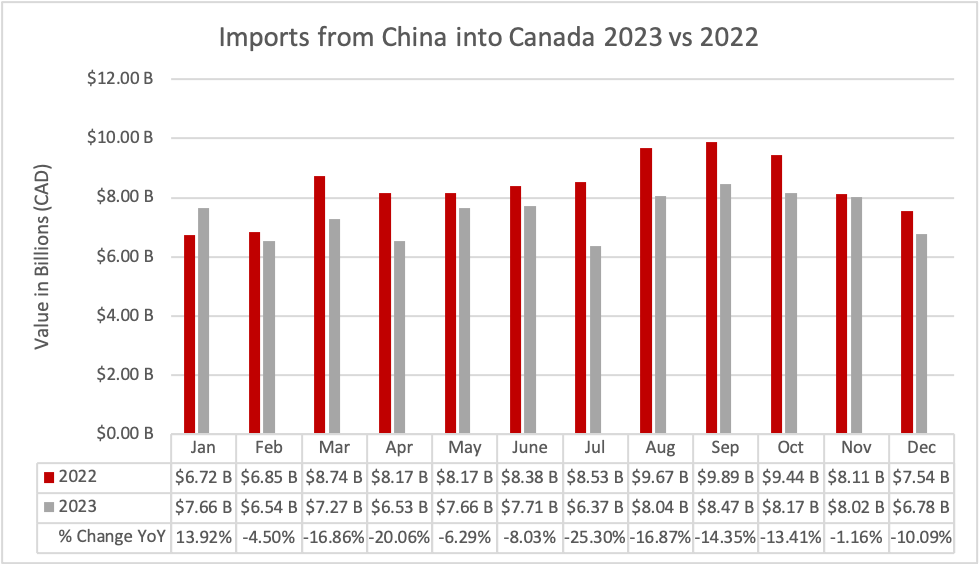

2. Canadian Imports from China

Canadian imports from China have been largely subdued throughout 2023, with each quarter showing contraction compared with 2022. For the entirety of the year, imports from China declined by 10.98% YoY, amounting to a total of $89.21 billion. This was contrasted by a 1.33% increase in overall imports from all countries, which reached $754.04 billion. As imports from China declined in 2023, Canadian imports from the United States increased by 2.10% YoY, and constituted a staggering $374.09 billion. It is worth noting that other major economies, such as the United States and Germany, also experienced declines in imports from China in 2023, illustrating that this trend is not contained to Canada alone and may be early evidence of the effects of emerging decoupling and de-risking strategies.

2023 did see a strong start for Canadian imports of Chinese goods, with January showcasing a robust 13.92% growth rate, but the remaining 11 months of the year saw substantial declines in imports from China. July, in particular, saw notably poor performance for Chinese imports into Canada, experiencing a YoY decline of 25.30%. As noted in the Q3 2023 Canada-China trade report, the significant decrease in July was likely partially caused by the BC port workers’ strike, which brought West Coast ports to a standstill for 13 days. Nevertheless, Canadian exports to China did not decline in July, thus indicating that the strike primarily affected flows of imports. The smallest decline was seen in November, with a 1.16% decrease, which is possibly reflective of increased consumer spending in the lead-up to the holiday season. However, this was not sustained through to December, which experienced a 10.09% decrease in imports from China.

Source: Trade Data Online (Statistics Canada – Customs Data)

The largest product category imported by Canada from China in 2023 was cellphones[7], which totaled $9.22 billion, though contracted by 6.23% YoY. As noted in previous quarterly reports, this large volume of Chinese-produced cellphones imported by Canada likely predominantly consists of non-Chinese brands manufactured in China, as opposed to Chinese cellphone brands. The second-largest Chinese import category to Canada was automatic data processing machines (e.g., computers)[8], which decreased 18.78% to reach a year-end value of $6.56 billion. Canadian imports of Chinese passenger vehicles[9] maintained momentum throughout the year, placing them as the third-largest import category, amounting to $2.64 billion and experiencing a remarkable growth rate of 325.80% YoY. Similar to cellphones, this meteoric growth in imports of Chinese-produced passenger vehicles is likely reflective of Western models produced in China – such as Tesla EVs – as opposed to Chinese vehicle brands, which are largely unavailable in the Canadian market as of 2023. The fourth-largest Canadian import from China was vehicle parts[10], showcasing a modest growth rate of 2.08% YoY and accounting for $2.39 billion. Finally, heaters[11] were positioned as the fifth-largest Chinese import to Canada in 2023, totaling $1.84 billion and growing by 50.93%. However, as noted in Q2 2023, the growth rate of heaters has slowed significantly over the course of the year, from 762.76% in Q1 to 50.93% by Q4, which may at least partially be caused by a decrease in residential construction and renovations in Canada this year.

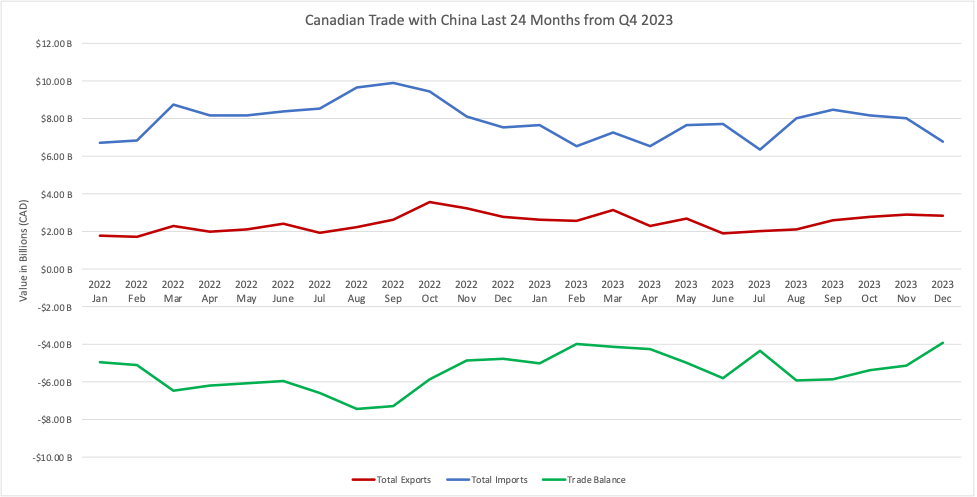

3. Canada-China Trade: A Two-Year Perspective

Source: Trade Data Online (Statistics Canada – Customs Data)

For most of 2022, imports were on a general growth trajectory before beginning to wane in the last few months of that year. Meanwhile, Canadian imports from China in 2023 rose and fell on a month-to-month basis, although the overall trend has been prevailingly negative when compared with the high-point of imports in September 2022, which totaled $9.89 billion in that month. Following the low-point of imports in July 2023 at $6.37 billion for the month, imports briefly rebounded in August and September before slowing through the autumn months and declining sharply again in December. It is likely that sustained economic challenges in Canada will continue to adversely impact the flow of Chinese imports into the country moving into 2024.

Similarly, Canadian exports to China throughout 2023 were subject to greater uncertainty than in 2022. In 2022, the volume of exports was generally diminished due to the zero-COVID policy pursued by Beijing, which was followed by a rebound in exports in the wake of the release of pent-up consumer demand following the lifting of COVID-19 restrictions. This rebound was sustained into Q1 2023, which saw robust growth in Canadian exports to China. However, China’s faltering post-COVID economic recovery throughout the remainder of 2023 led to exports fluctating month-to-month between growth to contraction. After reaching a yearly low-point of $1.90 billion in June 2023, exports slowly grew month-over-month for the remainder of the year, before ending the year off with $2.85 billion of Canadian exports to China in December 2023. Looking forward, should macroeconomic headwinds in China persist, that would entail that while Canadian exports may not significantly shrink in 2024, the large gains that Canada’s exports to China enjoyed at the beginning of 2023 would be unlikely to be repeated this year.

2023 has also seen similar fluctuations in the trade balance. Overall, the general decrease in Chinese imports to Canada and general increase in Canadian exports to China have diminished Canada’s trade deficit relative to 2022, which saw the trade deficit balloon to $7.43 billion for the month of August of that year. 2023 ended with Chinese imports to Canada diving and Canadian exports to China remaining at a relatively elevated – albeit stagnant, compared to November – level in December. This in turn led to December 2023 seeing a 24-month low for Canada’s trade deficit with China, amounting to $3.93 billion for the final month of the year.

4. Provincial Data

The exports of individual Canadian provinces and territories to China largely mirrored those of the country as a whole, with the majority of jurisdictions enjoying growth in their exports to the world’s second-largest economy. The three outliers were British Columbia, Newfoundland and Labrador, and Prince Edward Island, all of which saw YoY decreases of 6.92%, 8.69%, and 17.05%, respectively. Regardless of the YoY decline in BC exports to China, the province continues to hold the position as the largest exporter to China, totaling $8.07 billion in 2023. The prairie provinces of Alberta and Saskatchewan held the ranks of second- and third-largest exporters to China, respectively, largely owing to their vast natural resource endowments and the dominance of raw materials in Canada’s overall exports to China. Central Canada experienced robust growth in their exports to China in 2023, with Quebec and Ontario seeing their exports increase by 20.11% and 11.45%, respectively, which was driven by the mining industry in both provinces. Finally, Nunavut saw a meteoric growth rate of 176,518.85% in its exports to China, valued at $12.01 million, which was almost entirely driven by Nunavut’s increasingly developed mining industry.

Canadian imports from China declined overall in 2023, which was largely driven by parallel contractions in Chinese imports across the most populous provinces. Ontario, British Columbia, and Quebec all saw their imports of Chinese goods decrease by 11.36%, 10.29%, and 18.06%, respectively, in 2023. This was likely driven by sustained economic headwinds in these provinces, such as high debt levels and low consumer confidence. This is especially true of British Columbia and Quebec, which both saw their overall imports from all countries decline in 2023, albeit at a lower rate than their imports from China. The prairie provinces of Alberta, Saskatchewan, and Manitoba all experienced growth in their imports from China, which was likely driven by their position as having better short-term alignment with the Chinese economy. Finally, similar increases of Chinese imports in New Brunswick and Newfoundland and Labrador are likely reflective of consumers in those provinces having low debt loads, meaning that they are more insulated from the downward pressures on consumer confidence affecting provinces such as British Columbia and Ontario.

5. Trends and Topics

Dual Downturns: Macroeconomic Headwinds in China and Canada Foster Trade Volatility

Macroeconomic trends in both Canada and China have a substantial effect on the trajectory of bilateral trade between the two countries. This was particularly evident in 2023, as the unpredictable flow of trade between Canada and China occurred against a backdrop of significant macroeconomic challenges facing both Ottawa and Beijing. The adverse effects of the economic downturn in both Canada and China on bilateral trade were further exacerbated by broader geoeconomic dynamics, namely consumer goods supply chains increasingly shifting away from China towards lower income developing nations like India, Vietnam, and other Southeast Asian countries.

Following a year of subdued economic growth caused by China’s Zero-COVID restrictions in 2022, China started 2023 on a high-note in Q1, before it was confronted with substantial economic challenges and volatility for the remainder of the year. A beleaguered property sector, persistent deflationary pressures, weak external demand, and a rapidly aging population are some of the intersecting short- and long-term problems facing the Chinese economy, constraining the country’s ability to comprehensively recover from the pandemic.

China saw its GDP grow by 5.2% in 2023, which was in line with the central government’s target of “around 5%”. Despite this accomplishment, many other economic metrics painted a less optimistic picture. Chinese exports contracted for the first time since 2016, more than 20% of those aged 16-24 were unemployed, the economy underwent its longest deflationary streak since 1999, imports to China decreased on an annual basis, loans increased at their slowest pace since 2003, and several large property firms have either defaulted or posted significant revenue losses. These challenges have contributed to the erosion of consumer and investor confidence in China over the course of the year, which has served to further exacerbate many of these issues by depressing aggregate demand. Furthermore, a lack of substantive policy response by Beijing to the ongoing economic downturn served to amplify domestic and foreign dissatisfaction with the country’s economy.

The macroeconomic environment in China throughout 2023 was affected by, and impacted, its trade relationships. China saw exports to its major trading partners contract significantly, with both the EU and ASEAN seeing the volume of imported Chinese goods shrink, and Mexico overtaking China as the largest exporter to the US. As weak external demand weighed on China’s ability to export goods abroad, the economic downturn in China led to the country importing fewer goods from foreign countries, as the traditional engine of Chinese economic growth has been its export-led model. However, in terms of Canada-China trade, Canadian exports to China beat global trends and expanded in 2023, likely due to the largest product categories exported by Canada to China being natural resources that facilitate the economy’s basic functioning.

Meanwhile, Canada also experienced a year of underwhelming economic performance throughout 2023. The Canadian economy narrowly avoided a recession in 2023, posting a year-end GDP growth of 1.0%, but lackluster consumer and investor confidence have contributed to unpredictability in the country’s macroeconomic landscape. The decision of the Bank of Canada to keep the policy interest rate at 5% - the highest it has been since 2001 – in conjunction with high debt levels have contributed to dampened consumer confidence and lowered discretionary spending over the course of 2023. Indeed, as domestic consumption and investment declined in Canada, the main driver of GDP growth in 2023 was exports, namely natural resources such as oil and agricultural goods.

Canada’s imports of Chinese goods declined significantly in 2023 largely due in part to decreased Canadian consumer spending. Given that the majority of goods imported from China are cheap consumer goods such as electronics, the tightening of financial belts by Canadians throughout 2023 reflected in fewer imports from China. One notable exception was explosive growth in imports of vehicles from China; while Canadian consumer demand for cheaper goods retreated throughout the year, purchases of new vehicles increased overall in 2023.

As economic downturns in Canada and China contributed to volatility and fluctuations in bilateral trade flows throughout the year, an ongoing reorientation of global manufacturing for many consumer goods away from China towards other developing nations has also contributed to lower Canadian imports of Chinese goods. As China’s economy continues to mature, the price of Chinese labour has risen as the country moves up the global value chain, prompting many multinational corporations to relocate their manufacturing bases from China to countries with cheaper labour, such as Vietnam and India. As noted in the Q3 2023 Canada-China trade report, this developing geoeconomic paradigm shift has been reflected in bilateral trade flows between China and Canada, as the share of consumer electronics exported by Vietnam and India to Canada increased significantly in 2023, which coincided with a decrease in imports of the same goods from China. This is not unique to Canada, as 2023 saw US imports of cellphones from China decrease by 10% as the quantity exported to the US by India ballooned by nearly 500%; likewise, US imports of Chinese laptops shrank by 30% while Vietnamese laptop shipments to the US grew by approximately 400%. This manufacturing pivot away from China has been augmented by geopolitically-motivated Western efforts to reduce trade dependencies on China, such as Canada’s Indo-Pacific Strategy and the American Inflation Reduction Act (IRA).

Trade amidst Tumult: A Year of Deteriorating Diplomatic Relations Affects Economic Ties

Geopolitical and bilateral tensions, along with the growing geostrategic competition between Western countries broadly and China, had a clear effect on commercial ties between Ottawa and Beijing in 2023, with several events highlighting the Canadian government’s desire to reduce its trade and investment ties with China.

Throughout the first two quarters of 2023, Canada continued to signal its intentions to reduce trade dependence on China. In March, Ottawa’s budget underscored the importance of “friendshoring” as a strategic measure to prevent economic extortion by hostile foreign powers, a response widely interpreted as addressing the risks associated with over-reliance on trade with China. This sentiment was echoed by G7 diplomats in May, who advocated for enhanced “de-risking” from China. In the same month, Canada and South Korea took a tangible steep towards diversifying their trade portfolio by signing a critical minerals deal, accompanied by a commitment to bolster bilateral security cooperation. In alignment with this shift, Canada announced in June that it would temporarily suspend its participation in the Asian Infrastructure Investment Bank (AIIB), citing concerns about CCP dominance in the organization. Finally, in Q3, Canada entered into a formal strategic partnership with ASEAN, thus highlighting further moves to deepen Ottawa’s ties with the 10-nation bloc of emerging economies and mitigate over-reliance on China.

Broader global tensions aggravated already strained Canada-China relations throughout 2023. China’s tacit support for Russia’s invasion of Ukraine continued to damage its relations with many Western nations, including Canada. Furthermore, the crisis in Gaza, Houthi attacks in the Red Sea, and multiple coups in Africa created shocks in global commodity markets, impeding the broader economic recovery from the COVID-19 pandemic. These numerous geopolitical flashpoints resulted in declining global growth projections throughout 2023 and contributed to the unpredictability of Canada-China trade ties, especially given the prominent role that commodities play in bilateral trade flows between the two nations.

The events of 2023 underscored a deepening rift in Canada-China relations, significantly influencing trade and investment dynamics. Amidst ongoing debates regarding Chinese influence and interference, interactions with Chinese entities are facing increased scrutiny in Canada. Consequently, Canadian investors and companies will possibly show growing hesitancy in engaging in business with China moving forward, and long-established partnerships have been strained due to increased attention prompted by national security concerns. Similar sentiments have also arisen among Chinese investors, given a perceived lack of policy clarity from Ottawa regarding the openness of the Canadian market to Chinese investment, thus further acting as a strain on bilateral commercial ties.

Uncertain Horizons: Possible Developments in Canada-China Trade in 2024

The global economy has been increasingly unpredictable and volatile following the end of the pandemic, as countries grapple with several simultaneous and interconnected challenges, ranging from an international cost of living crisis to large-scale wars in Ukraine and the Middle East. The trajectory of world trade throughout 2024 will be guided largely by how economic downturns and geopolitical tensions across many countries develop this year. In terms of Canada-China trade, several key factors will figure prominently in determining the flow of goods between the two countries in 2024, including the domestic economic performance of both Canada and China, diplomatic tensions between Ottawa and Beijing, and broader geopolitical and economic dynamics.

The Canadian economy entered 2024 in a weary state, marked by muted domestic demand driven by high interest rates, elevated household debt levels, and productivity concerns. Although the Canadian economy beat many economists’ expectations in 2023 by narrowly avoiding a recession, the decision of the Bank of Canada (BoC) to keep interest rates high moving into 2024 continues to act as a downward pressure on consumer confidence, which in turn will likely contribute to decreased imports from China. However, the BoC’s first rate reduction in June means that we could potentially see a rebound in Canadian imports from China the second half of the year as consumers receive relief from high debt costs. However, as long as interest rates remain high, Canadians’ appetite for discretionary spending on Chinese imports will likely remain subdued.

In line with 2023, it is possible that the prairie provinces will continue to see their imports from China grow in 2024, given the continued robust economic performance of this region. Likewise, the heavily indebted consumers of British Columbia, Quebec, and Ontario will potentially still feel the squeeze of high interest rates for at least the first six months of 2024, which may cause lower discretionary spending and thus decreased imports from China. Overall, the macroeconomic conditions that led to a contraction in Canadian imports from China in 2023 have persisted into 2024, meaning that the trend of lowered Chinese imports could likely similarly endure.

On the heels of an uneven post-pandemic recovery in 2023, the Chinese economy has assumed paramount importance for the ruling Communist Party in 2024. While the final months of 2023 saw a slight uptick in economic activity in China, 2024 has been marked by continued headwinds, such as a protracted downturn in the property sector and an underperforming stock market. Beijing has signaled in the first months of 2024 that it is prepared to take action to remedy the challenges facing the economy. This has included targeted stimulus measures intended to alleviate local government debt and to support the real estate market. In March, at the National People’s Congress (NPC) – China’s national legislature – the government outlined the same economic targets for 2024 as last year, which indicates a cautious optimism among the country’s leadership for the year ahead.

The increased possibility of macroeconomic stabilization in China this year means that Canadian exports to the country may continue to grow. 2023 illustrated that exports from Canada to China are quite resilient and can withstand an economic downturn in China, which is likely due to the fact that the majority of Canadian goods shipped to China are essential primary goods and natural resources like agricultural goods and iron. The prospect of a comprehensive post-pandemic economic recovery in China coupled with Beijing’s increasing priority on upgrading its manufacturing capabilities means that Canadian exports to China could benefit from these policy objectives if they are realized this year. In particular, the insistence on building up China’s advanced manufacturing capabilities as a pillar of Chinese economic policymaking means that major products exported to the country by Canada, like copper and iron, could face increased demand. Furthermore, the opening of the Trans Mountain pipeline – planned for Q2 2024 – will potentially facilitate a massive increase in Canadian exports of oil to the entire Indo-Pacific region, including China, the world’s second-largest consumer of oil. However, despite the many potential avenues for Canadian exports to China to grow in 2024, Canadian producers will still face challenges including competition from similar resource exporting economies like Russia and Australia, large Chinese inventories of goods like iron potentially decreasing demand for imports of such products in the short-run, and the possibility that Beijing will not be able to reverse the country’s economic downturn.

Notwithstanding the prevailingly negative view of China among the Canadian public, Ottawa and Beijing have recently indicated that they may be willing to attempt to reset relations after years of simmering tensions. In line with Canadian Foreign Affairs Minister Melanie Joly’s recent articulation of a “pragmatic diplomacy” that seeks to “engage ‘countries of different perspectives’”, Joly met with Chinese Foreign Minister Wang Yi at the beginning of 2024 and pledged to “find common ground and maintain communication”. Furthermore, as Beijing attempts to navigate the ongoing economic challenges it faces, it is likely to attempt to soften its diplomatic approach towards high-income Western countries, as China cannot as easily afford to sacrifice economic ties on the altar of geopolitical competition. Many observers noted that Xi’s visit to San Francisco in November 2023 potentially signaled the Chinese government attempting to restore constructive engagement with Western countries as a means of fostering a more open international trade and investment environment for the country. This was also underscored at the CCP’s 2023 Central Economic Work Conference (CEWC) and in the Governmental Work Report (GWR) at the 2024 NPC, both of which set China’s economic policymaking priorities for the remainder of the year. Nevertheless, it is possible that Ottawa and Beijing could find it difficult to recalibrate the bilateral relationship given fundamental asymmetries in how the two governments view each other. Furthermore, signals so far in 2024 indicate that the Canadian government still prioritizes diversifying its Indo-Pacific supply chains away from China, which was a trend noted in 2023.

Finally, the global geopolitical and economic landscapes of 2024 will affect Canada-China trade throughout the year. Ongoing conflicts such as the Russo-Ukrainian War and the Israel-Hamas conflict will likely act as a strain on diplomatic ties between Ottawa and Beijing, and possibly have an adverse effect on bilateral trade stemming from higher global commodity prices. China’s refusal to condemn Russia’s invasion of Ukraine and enforce Western-led sanctions against Moscow has acted to further deteriorate relations between Beijing and the West. It is unlikely that China will reverse its tacit support for Russia in 2024, meaning that this will continue to be a bone of contention between Beijing and Ottawa for the foreseeable future. China’s willingness to act as a “backdoor” for Russian exports amid Western sanctions could also decrease Chinese demand for Canadian goods, because Beijing is able to purchase products like wheat and oil from Russia at a substantial discount, thus providing Russian producers with a significant competitive edge in the Chinese market over Canadian exporters. Furthermore, current wars in Ukraine and the Middle East have had a distortionary effect on global prices for commodities such as grain and oil. Increased prices for these goods could result in lower demand for them in China, which would constitute a downward pressure on the growth of Canadian exports to China given that such commodities form the majority of Canadian products imported by China. An additional factor that could decrease Canadian exports to China is OPEC’s decision to cut oil production into 2024, thus driving energy prices up. In particular, increased commodity prices resulting from potentially high transport costs caused by higher energy prices could adversely affect Canadian exports to China, as the majority of products exported from Canada to China are commodities. However, it is worth noting that the effect of possibly higher energy costs throughout 2024 could also prove beneficial to Canadian oil exports to China through the newly-expanded Trans Mountain Pipeline.

Many of the challenges that faced bilateral trade between Canada and China in 2023 will continue into 2024. While 2023 underscored the resilience of Canadian exports to China, domestic macroeconomic headwinds, contentious Canada-China diplomatic relations, and an unpredictable global landscape all have the potential to exert negative influence. There is, however, room for optimism, as a reversal of the economic downturns in both countries and a more constructive engagement between Ottawa and Beijing remains possible in 2024. Despite the ambiguity of the eventual outcome of Canada-China trade in 2024, it is evident that economic ties between the two countries are becoming more unpredictable and volatile, as the relationship is increasingly subject to multifaceted influences that escape the control of either Ottawa or Beijing alone.

[1] Please note that some sums and percentage points may not add up perfectly on tables and graphs due to rounding.

[2] HS4 product group: 1205 – Rape or Colza Seeds (Whether or Not Broken)

[3] HS4 product group: 2701 – Coal and Solid Fuels Manufactured from Coal

[4] HS4 product group: 2601 – Iron Ores and Concentrates

[5] HS4 product group: 4703 – Chemical Woodpulp – Soda or Sulphate

[6] HS4 product group: 2603 – Copper Ores and Concentrates

[7] HS4 product group: 8517 – Telephone Sets; Other Apparatus For Trans/Recep of Voice/Image/Data, O/T 84.43, 85.25, 85.27, 85.28

[8] HS4 product group: 8471 – Adpm & Units, Magnetic/Optical Readers, Machine Transcribing Data To Media in Code & To Process

[9] HS4 product group: 8703 – Motor Cars and Other Motor Vehicles Principally Designed for the Transport of Persons (Other Than Those of Heading 8702), Incl. Station Wagons/Racing Cars

[10] HS4 product group: 8708 – Motor Vehicle Parts (Excl. Body, Chassis, and Engines)

[11] HS4 product group: 8419 – Non-Domestic Dryers and Temperature Changing Apparatus; Instantaneous Water Heaters

Authors

Daniel Lincoln

Policy Research Analyst

Daniel is a recent graduate of the University of Alberta, completing a BA With Distinction in Political Science, Economics, and History. Daniel also received a Certificate in Globalization and Governance that he completed in conjunction with his undergraduate degree. His primary research interests include Russian and Chinese foreign policy, international trade, security policy, and Canada's geopolitical and economic role in the Arctic.