Capital Asset Account Coding

When making a purchase, it is important to assess whether or not the item being purchased constitutes a capital asset ("capitalized" by coding to a 507xxx account) or an expense ("expensed" by coding to a 502xxx account). While users see the purchase of capital assets reflected as expenses on their financial reports, for institutional accounting and reporting purposes, capital assets are amortized (i.e. expensed) over their useful lives.

The University applies the following criteria in determining whether a capital asset is being purchased:

- The item being purchased is $5,000 or more (=or>$5,000) in value per unit (before other related costs including customs, freight, delivery, foreign exchange gain or loss, installation, and training costs)

- The item has a future benefit to the University and a useful life greater than one year (i.e., will not be "consumed" such as office supplies, lab supplies)

- The item is the property of the University of Alberta (unless otherwise stated by sponsor terms)

Exceptions to these criteria include books, permanent collections, and construction and renovations which are limited to specific units on campus. See Other (below) for additional information.

Equipment Asset Management Procedures

University-owned moveable equipment assets including scientific lab, information technology (IT) and other equipment and vehicles are tagged and tracked by units. This includes items acquired through the Professional Expense Reimbursement program.

The University has UAPPOL procedures for appropriately disposing of equipment assets that are no longer needed or no longer being used. Units are responsible for following these procedures to ensure the required approvals and any applicable accounting entries are made to record these disposals.

Refer to Guide Chapter 6: Equipment and Furnishings Assets for further information.

Examples

Examples of purchases of capital assets and other related costs, and the appropriate account coding are as follows:

|

DESCRIPTION |

COST |

ACCOUNT CODE |

|

Stand-alone lab equipment |

$6,500 |

507012 EquipScientificLab=or >$5,000 |

|

Multiple stand-alone items on one order (e.g., purchase of five computers on one order) |

Total $10,000 A. 1 computer: $6,000 B. 4 computers: $1,000 each |

A. 507025 Computer Hardware=or>$5,000 |

|

Multiple components that make up a single item or "system" on one order (e.g. components for a microscope that cannot be used individually) |

Total $12,000 (12 items @ $1,000 each) |

507012 EquipScientificLab = or >$5,000 |

|

Multiple components that make up a single item or "system" plus some other items on one order |

Total $12,500 A. 10 components of a digital analyzer @ $1,000 each B. 5 individual items @ $500 each, unrelated to the digital analyzer |

B. 502344 Scientific Lab Equip<$5,000 |

|

A. Stand-alone equipment from the USA B. Customs charge processed the month after receipt and payment |

A. $7,000 B. $100 |

A. 507001 Equipment Other=or>$5,000 B. 507001 Equipment Other=or>$5,000 (always same account code as purchase; if purchased through requisition process, this account code will be assigned automatically) |

|

A. Computing equipment B. Extended warranty for computing equipment |

A. Computer (server) - $5,500 B. Warranty - $1,000 |

A. 507025 Computer Hardware=or>$5,000 B. 502119 Warranty |

|

Expense paid for equipment brought to Canada for demonstration purposes or conference and will not be purchased |

$7,000 |

504xxx (rental and lease account) or 502101 Supplies & Services General |

|

Laptop reimbursed from Professional Expense Reimbursement (PER) |

$1,000 |

501113 - Other Benefits (PER coded automatically through Travel & Expense module) |

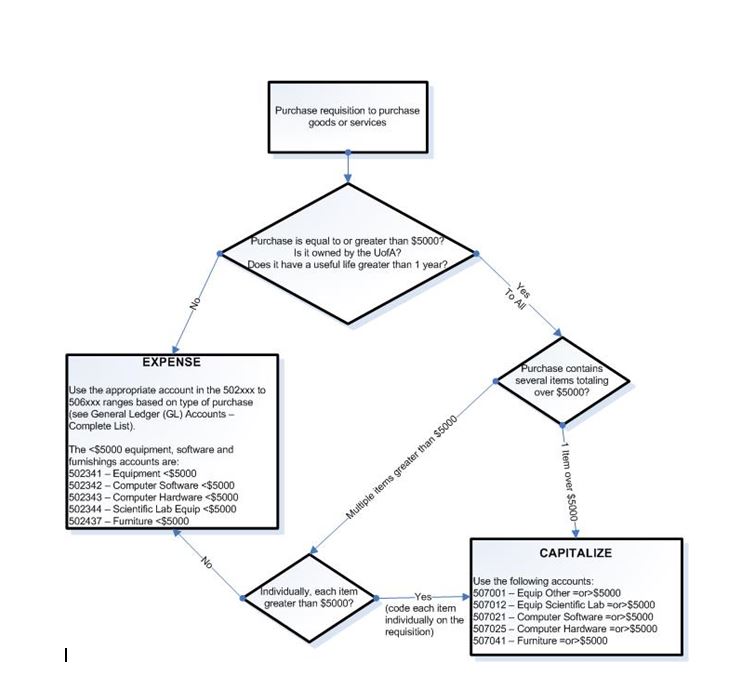

Decision Tree: Whether to Capitalize or Expense

Other

The purchase of books, journals and reference materials by the Library and Museums for the use of all staff, students, researchers and public in the University library system are capitalized to specific 5072xx accounts that are restricted for use by Library and Museums only.

All other units purchasing books, subscriptions or other learning resource materials for their own departmental use must use account:

- 502203 - Books & Publications (also includes subscriptions)

Regardless of value (i.e. the $5,000 threshold does not apply), the acquisition of artwork, rare books, archival materials and museum artifacts are expensed to the following accounts:

502501 - Rare Books & Archival Material (account is restricted to Library and Museums)

502511 - In Kind - Oth Perm Collections (account is restricted to Financial Reporting and Office of Advancement)

502521 - Artwork

Construction and renovations by Facilities and Operations (F&O) that are classified as capital assets are coded to 5074xx and 5075xx accounts that are restricted for use by F&O only. No other department should be coding to this range of accounts.

If a unit's renovations are being done by F&O, F&O will make the determination as to whether the cost is to be capitalized or expensed as non-capital renovations. F&O will process these charges to the unit via a JOB journal.

Maintenance and repairs contracted by other units (other than F&O) would be non-capital and must be coded to account 503401 (Maintenance & Repairs General).

Last Updated: November 2024