Canada-China Trade: 2021 Q3

Darren Choi - 31 January 2022

Canada-China Trade: 2021 YTD

Source: Trade Data Online (Statistics Canada – Customs Data)

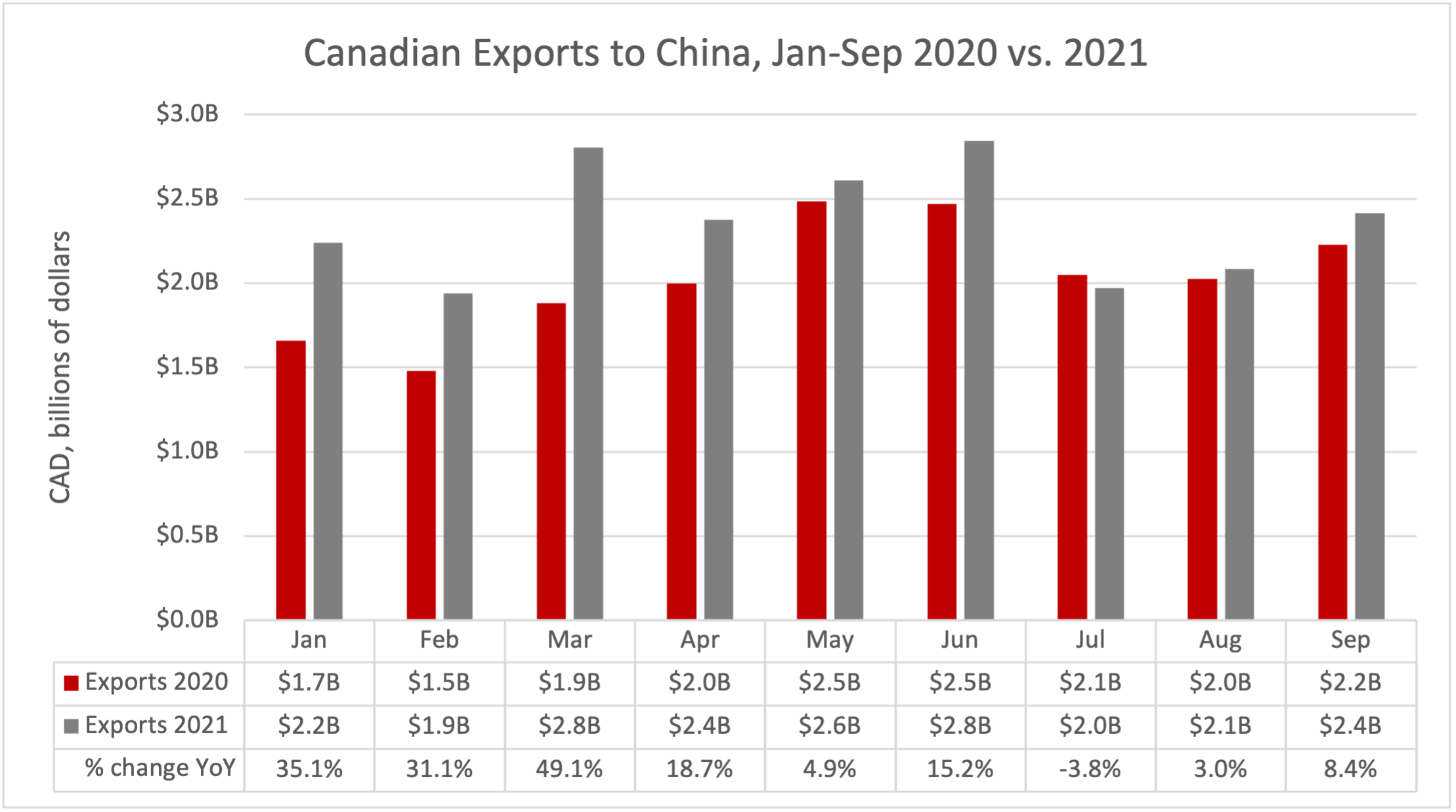

The third quarter of 2021 saw Canadian exports to China grow 16.5% year-over-year, a slowing of the strong upward trend observed throughout the year. For the first time since 2019, year-over-year growth in total Canadian exports (20.4%) outpaced year-over-year growth in exports to China. This was driven by an overall recovery in Canadian exports, as seen by the 20.6% growth in Canadian exports to destinations other than China.

July 2021 saw a slight drop in Canadian exports to China (-3.8% YoY) when compared to July 2020. This was made up for by an increase in August (3.0% YoY) and a significant jump in September (8.4% YoY).

Bituminous coal ($2.1 billion, +292.6% YoY) exports to China saw a dramatic near-300% growth year-on-year, placing it as Canada’s leading export category to China through the first three quarters of 2021. Non-agglomerated iron ore ($1.9 billion, +1.1% YoY), chemical wood pulp ($1.7 billion, +31.4% YoY), copper ore ($1.5 billion, +97.6% YoY), and canola seed ($1.2 billion, +97.6% YoY) made up the rest of the top five.

Canadian imports from China grew at a steady 13.7% year-over-year through the first three quarters of 2021; imports from China outperformed Canadian imports from other countries, which grew a combined 12.6% year-over-year in the first three quarters of 2021.

Canadian imports from China fell in July (-9.0% YoY). However, this was again reversed by significant growth in August (+7.9% YoY) and September (+18.9% YoY).

The top 3 import categories in the first three quarters of 2021 remained unchanged from Q2 2021, dominated by three consumer electronics product categories: laptops ($4.5 billion, +3.4% YoY), cell phones ($3.5 billion, +18.0%), and network devices such as modems ($1.7 billion, +14.8% YoY). Children’s toys, puzzles, and models ($879.1 million, +11.3% YoY) were the fourth largest import category. Finally, non-surgical rubber gloves ($651.6 million, +301.7% YoY) climbed to the fifth largest spot with a noticeable 300% year-over-year growth for the first three quarters of 2021.

Canada-China Trade: Last 24 months (October 2019 – September 2021)

Source: Trade Data Online (Statistics Canada – Customs Data)

Q3 Canada-China Trade: By Province/Territory

Source: Trade Data Online (Statistics Canada – Customs Data)

Trends & Topics in Canada/China Trade

Canada-China Trade after the release of Meng Wanzhou and the Two Michaels: Less Change than Anticipated?

The largest story in Canada-China relations during Q3 was easily the resolution of the extradition case of Huawei executive Meng Wanzhou, and the simultaneous release and return of both Michael Spavor and Michael Kovrig back to Canada. For nearly three years, the cases of Ms. Meng and the Michaels have dominated Canada-China relations, sparking deep tensions between the two countries; the effects of such tensions on Canada-China trade, however, are less clear.

Some aspects of the Canada-China trade were certainly affected by the deterioration in relations; China’s imposition of bans and restrictions on exports of Canadian canola has been closely linked to the diplomatic tensions created by the arrest of Meng and the Michaels. On the other hand, while specific cases like Canadian canola have dragged on, overall Canada-China trade continued mostly unabated. Our trade reports throughout 2020 and the first two quarters of 2021 show that both Canadian exports to and imports from China grew at a steady rate – often outperforming Canadian trade with other countries.

In many respects, the releases of Meng and the Michaels have changed very little with respect to Canada-China trade. There has been strong trade growth throughout a historic low point in Canada-China relations; Canada-China trade was robust enough to defy even the global decline in trade seen in 2020 due to COVID-19.

However, the recovery in diplomatic relations might still have some effect on more specific files within Canada-China trade. Canola is once again the most notable example; farm groups hope that a decrease in tensions will make room for negotiation of Chinese restrictions on Canadian canola. One should also note, however, that, beyond the current restrictions, Canadian canola seed exports to China nearly doubled through the first three quarters of 2021. At the time of this report, the situation remains unresolved.

Conversely, lingering tensions and fears from this saga may hamper future growth in Canada-China trade, business, and investment. Despite the release of the two Michaels, Canadian businesses continue to report reluctance in trading and operating within China.

Overall, the numbers seem to show that the ups and downs of the diplomatic relationship have not yet had a significant effect on the overall trend of growth in Canada-China trade. There is little reason to believe that trend seen during the saga of Meng Wanzhou and the two Michaels will not continue now that it has been resolved.

China and Taiwan offer rival bids to join CPTPP

Canada is among the eleven signatories of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, or CPTPP; the CPTPP is a successor to the original Trans-Pacific Partnership (TPP), which failed due to the withdrawal of the United States in January 2017. Even without the United States, CPTPP’s signatories have a combined GDP of about $13.5 trillion, or 13.4% of global GDP, making the agreement among the largest free trade deals in the world.

On September 16, 2021, the People’s Republic of China applied to join the CPTPP. A mere six days later, Taiwan formally applied to join CPTPP as well. The near-simultaneous applications from both sides of the Taiwan Strait have set the two bids as rivals for the future of the trade pact.

China’s application was more surprising but was seen immediately by many as a savvy move. One of the main purposes of the original TPP agreement had been the exclusion and “containment” of China; TPP would have had the economic weight to counter China and force China to follow the rules of global trade more closely. China’s accession to a now America-less CPTPP would change the dynamics of the trade pact considerably; rather than draw the economies of the Asia-Pacific away from China (and towards the US), a China dominated CPTPP would likely orient these nations towards China.

China faces hurdles, however, in the form of CPTPP’s strict entry requirements and opposition by members increasingly unfriendly with China (Canada included). China would have to undertake serious reforms to meet CPTPP standards with respect to its digital economy, state-owned enterprises, and labour standards, to name a few. Furthermore, China’s failure to fully transition to a market-based economy in the 20 years since its accession to the WTO will likely keep many members wary of similar accommodations for China within CPTPP. Compounding this wariness are other tensions between China and multiple members of CPTPP. Canada, Australia, and Japan are among the leading CPTPP members that have reacted coolly to China’s application. On the other hand, Chinese membership in the CPTPP would offer significant economic benefits and further access to one of the world’s largest economies; members such as Malaysia or Vietnam may prove more amenable to Chinese membership in the pact.

Taiwan’s application, in contrast, was far more expected and welcomed by many of CPTPP’s members. Joining CPTPP has been at the top of Taiwan’s strategic agenda for some time, and its government has lobbied member states extensively. Many observers note the protection CPTPP membership would offer Taiwan, aligning it closely with other nations within the Asia-Pacific region. However, members may be reluctant to risk the wrath of China by allowing the self-governed island to join CPTPP.

CPTPP is undergoing a period of rapid expansion; the United Kingdom, Ecuador, and South Korea have all submitted applications. The question of both China and Taiwan, however, is likely the most complicated. The prospect of allowing membership to either, neither, or even both each bring with it their own complications. Moreover, the United States remains mostly absent from the table. As one of the founding members of CPTPP, Canada will play a major role in the discussions over China and Taiwan’s applications in the months and years ahead.

Explosive growth in Canadian coal exports in the shadow of COP26

One story we have closely followed throughout 2021 is the explosive growth in Canadian exports of coal to China. For Q2, we noted that coal-dependent China was facing a significant energy crisis; large energy demands and soaring coal prices meant China is struggling to find the fuel needed to power its economy. This energy crisis continued to deepen throughout Q3 2021. Many factories were forced to limit or shut down production due to a lack of electricity, and energy and heating prices soared. This, of course, creates a significant Chinese demand for coal, and Canada has been among the major coal-exporting nations that have been fulfilling this need. It is clear that Canada has double-downed on coal exports throughout Q3, posting a staggering near-300% growth in coal exports to China as compared to the same period in 2020.

However, the COP26 conference in November reminds us of the significant climate implications of coal use. Prime Minister Trudeau made a promise to world at COP26 to end the export of thermal coal by 2030, a statement that has significant implications for the future of Canadian coal sales overseas. China, on their part, made global waves when they, in cooperation with India, forced the language of the COP26 agreement to allow countries to “phase down” coal, rather than “phase out.” President Xi pledged that this “phasing down” would begin in 2026, a date that disappointed many climate campaigners.

For now, Canadian coal continues to cross the Pacific at an astonishing rate. How long Canada-China coal trade will continue is far from certain.

Author

Darren Choi

Policy Research Assistant

Darren Choi is a Policy Research Assistant at the China Institute at the University of Alberta and a BA graduate with a major in Political Science and a minor in history.