Professional Accountant

Path to the CPA

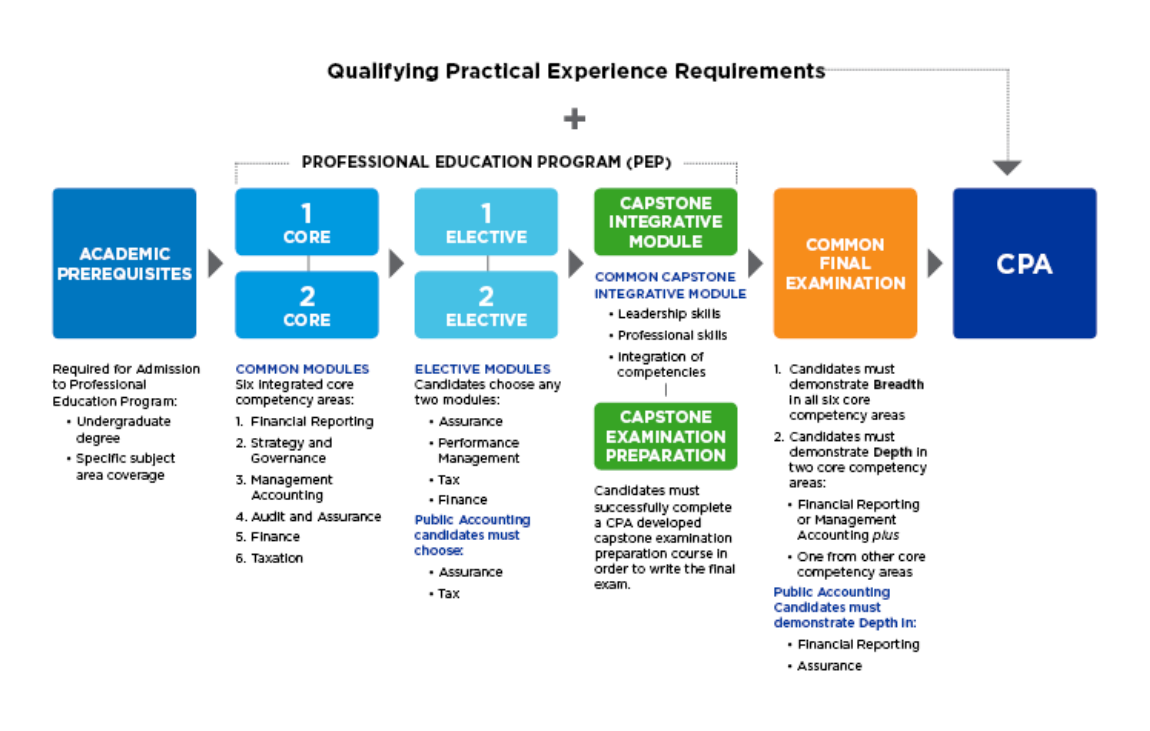

Individuals need to complete formal professional education, a common final exam, and meet relevant practical experience requirements.

Learn more about the Professional Education Program (PEP) on the CPA Alberta website.

Professional Education Program

Future CPAs are required to complete the six-module Professional Education Program (PEP) before they would be allowed to write the common final examination. The CPA PEP courses can be completed through CPA Canada (in Western Canada these would be completed through the CPA Western School of Business), or through an accredited Master of Accounting program. In order to enter the CPA PEP, or a Master of Accounting program, you would need to hold an undergraduate degree and also meet certain prerequisite courses. All of the required prerequisite courses can be completed while pursuing the MBA, but you would also be able to complete these prerequisite courses through the CPA Prerequisite Education Program (CPA PREP).

Practical Experience

In addition to formal education and the common final examination, the CPA certification program requires CPA students/candidates to complete a term of relevant practical experience. The knowledge and competencies gained through practical experience complement those developed through education.

The standards for practical experience apply to certification for entry into the profession only.

CPA Practical Experience Requirements

Required Courses

You will need to complete the following courses as part of your MBA program to satisfy the entrance requirements for the CPA Professional Education Program:

The application of accounting methods to incorporate investments and other advanced topics in financial reporting.

Experiential Learning

As part of our MBA capstone course (SMO 641: Business Strategy), you will work with an outside organization on a strategic issue they are facing. Your team will identify the issue and potential solutions, recommend a course of action and develop an implementation plan for your client. This provides an opportunity to apply what you've learned in the Alberta MBA in a real-world setting and gain experience during your studies.

With the Alberta MBA, you'll be able to advance and develop your overall business skills, while also meeting the prerequisite courses required to enter the CPA Professional Education Program.

Chartered Professional Accountant (CPA) Designation

The Canadian Chartered Professional Accountant (CPA) designation prepares you for a life-long, rewarding career with unlimited potential. A CPA is your gateway to a world of exciting opportunities. With over 185,000 members, you're part of one of the world's largest, most prestigious and influential accounting organizations. Regardless of your industry sector, your job is to be a forward-thinking financial leader and to apply the knowledge you've gained from the CPA designation to make important financial and business decisions.